In today’s fast-paced world, people want everything to be quick, easy, and convenient, especially when managing their finances.

Digital wallets have revolutionized how people handle their money. It allows them to make transactions quickly and securely without needing cash or physical cards.

With the rise of digitalization, the demand for digital wallet apps has also surged. Digital wallet app development can be a lucrative business opportunity but also requires careful planning and execution.

As per Statista, digital wallet apps like Apple Pay and Google Pay are expected to grow double in North America from 2020 to 2025. However, the market size in Asia will still be significantly larger. So, if you want to leverage this vast market, developing a digital wallet app would be best.

So, whether you are a startup, entrepreneur, or business owner looking to expand your offerings, let’s dive into the world of digital eWallet app development.

This blog will guide you through a digital wallet’s complete development process, features, cost, and tech stack.

What is a Digital Wallet?

A digital wallet is a software-based system enabling individuals or businesses to make transactions electronically. It uses credit/debit cards and lets the app users make purchases using their mobile devices.

Digital wallets, also known as eWallets, are financial tools that eliminate the need to carry a physical wallet to store funds, make transactions, and track payment history. People can also keep loyalty cards, reward points, and coupons, making it easier for users to access them.

There are several benefits of digital wallet apps for businesses, such as:

- eWallet apps offer easy payments solutions, such as by scanning QR codes or manually entering registered phone numbers.

- Digital wallets allow feasible transactions on cryptocurrency trading apps.

- It promotes fintech, banks, and various businesses in innovative forte.

- It enhances security in digital transactions via several measures like 28-bit encryption, two-factor verification, biometrics, and voice initiation.

- It showcases financial reports presenting exchanges and deals with financial planning.

- Facilitate frictionless transactions; thus, it can be an effective tool for managing daily transactions.

- It enables easy cancellations and refund processes.

Quick Fact – According to Statista, the total digital payments value is predicted to touch an annual growth rate (CAGR 2023-2027) of 11.79% resulting in US$14.79tn by 2027.

How Do Digital Wallet Apps Work?

Digital wallet apps securely store a user’s payment information on their mobile device, such as credit card or bank account details.

When a user wants to make a payment, they can open the app and select the payment method they want. The app then securely sends the payment information to the merchant’s payment gateway, which processes the transaction.

eWallet applications use different technologies to facilitate transactions. Let’s look at them.

- Quick Response (QR) codes – Users can make payments by scanning a code displayed on the merchant’s payment terminal using their smartphone camera.

- UPI (Unified Payment Interface) – The real-time payment system facilitates peer-to-peer interbank transactions through a streamlined two-factor authentication process, providing users with a secure and efficient transaction experience. This technology eliminates the need for repeated entry of sensitive information such as CVV codes and PINs, resulting in a hassle-free and swift transaction process.

- Near Field Communication (NFC) – This technology facilitates the transmission of payment information between two NFC-enabled devices nearby. Notably, merchants must have the appropriate equipment to facilitate NFC mobile payments. However, most modern payment terminals are embedded with NFC technology and chip readers, eliminating equipment-related issues.

- MST (Magnetic Secure Transmission) – This technology produces a magnetic signal replicating a conventional payment card upon swiping, enabling users to make payments swiftly and effortlessly without retrieving their wallet manually.

Integrating these technologies to facilitate transactions in your digital wallet design may be challenging. Therefore, you require experienced mobile app development services to carefully & securely create an eWallet app.

Types of Digital Wallet Apps

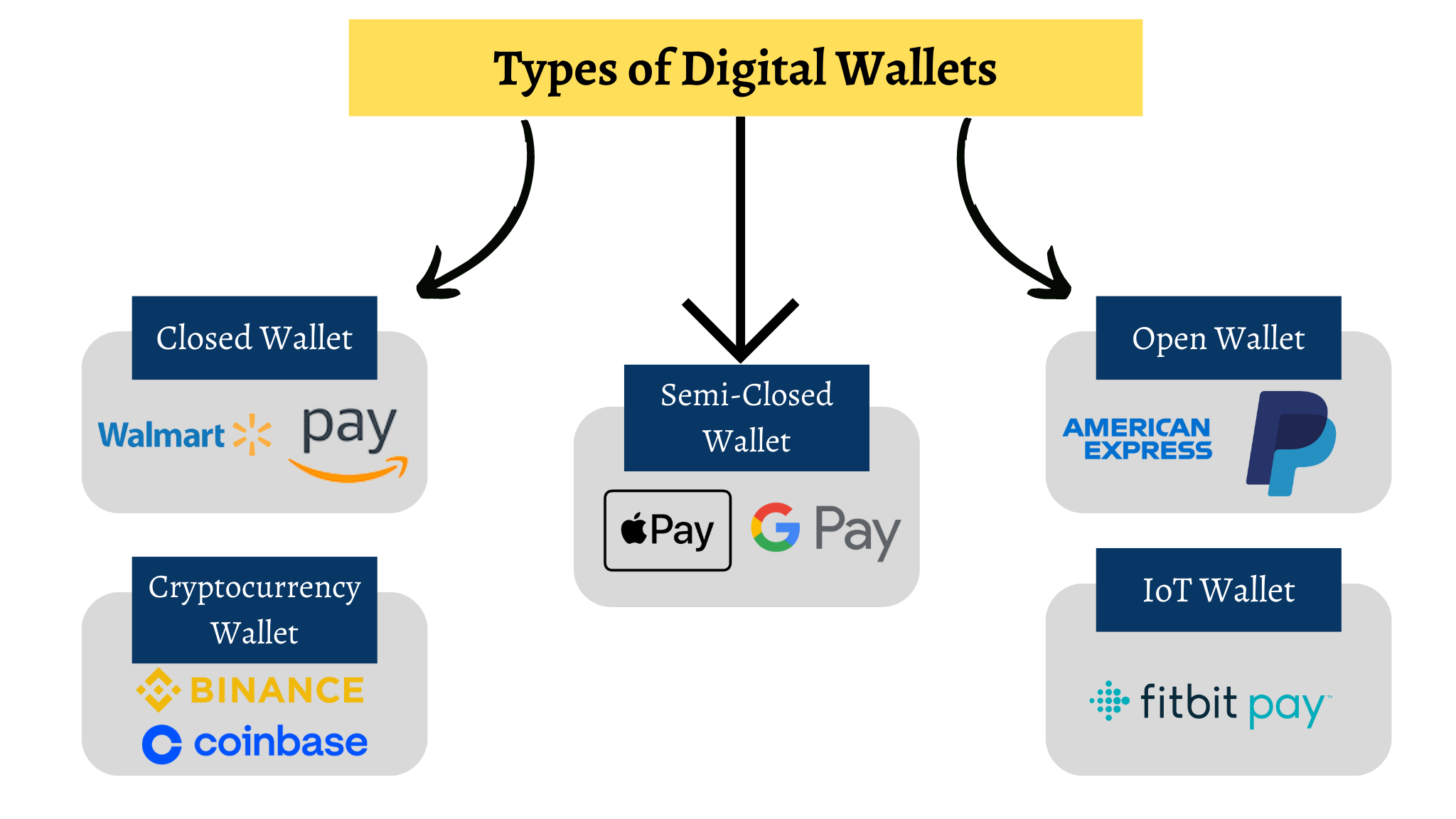

Closed Wallet

Closed wallet apps are designed to make payments for a particular store, app, or website. These wallets are issued by businesses to sell products or services to their target customers. And a user can use a closed wallet to make payments with the wallet’s issuer only.

It serves limited audiences, and in case of refunds, the amount is stored in the wallet.

Examples: Walmart pay, Amazon Pay, etc.

Semi-Closed Wallet

Companies can accept the contract or agreement with the eWallet company to use the services of these apps. It allows merchants and store owners to make transactions at the listed locations easily.

Examples: Apple Pay, Google Pay, etc.

Open Wallet

These are the most commonly used eWallets enabling transactions to a different eWallet using a single platform. However, it is necessary to have user accounts for both the sender and the receiver on the same application.

Examples: American Express, PayPal, etc.

Cryptocurrency Wallet

These wallets allow you to store and transfer cryptocurrencies. As cryptocurrency ownership certificates, users’ public and private keys are stored in crypto wallets.

Based on internet connectivity, cryptocurrency wallets can be categorized as cold and hot.

- Hot wallets are connected to the Internet and are more user-friendly. However, these wallets are less secure.

- Cold wallets do not need internet connectivity and are stored offline. Therefore, security is improved in these wallets and possesses less risk.

Examples: Binance, Coinbase, etc.

IoT Wallet

IoT wallets operate with e-money or virtual currencies. IoT (Internet of Things) enables eWallets on wearable devices like smartwatches, wrist bands, etc., or smart electronic appliances like smart refrigerators.

For Example, Fitbit Pay allows you to access your credit or debit card via your wearable device.

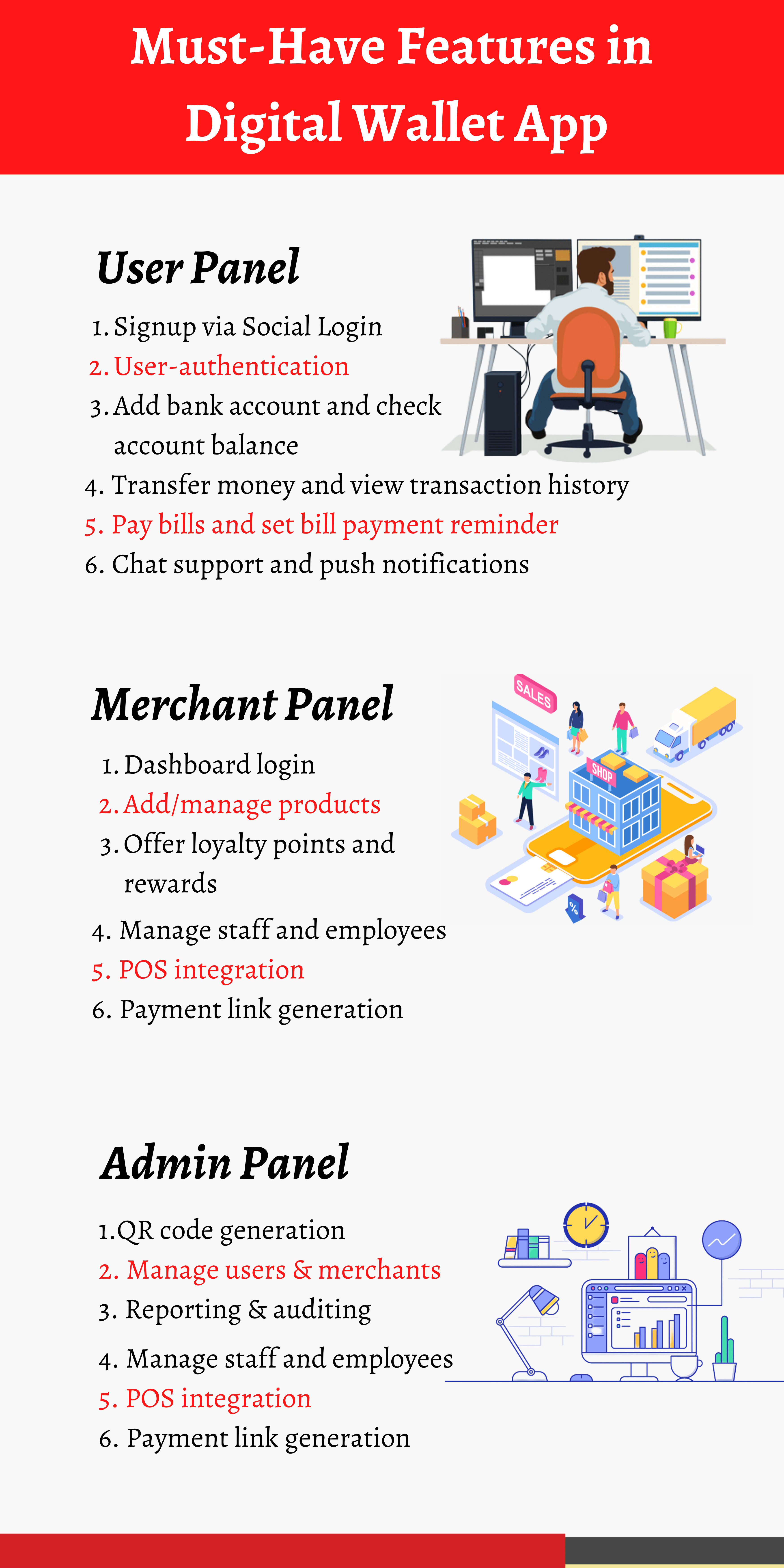

Key Features to Include in Digital Wallet App

The digital wallet app is divided into three separate panels, User, Admin, and Merchants. Each panel has its own set of features that you can include in your application. You can hire a digital wallet app development company to build digital wallet that delivers promising results without hampering the user experience.

User Panel Features

- Signup via Social Login

- User authentication via pin, pattern, and Face ID

- Add authorized bank account

- Check account balance

- Transfer money via contact number or QR code scanner

- Pay bills and set a bill payment reminder

- View transaction history

- Multi-currency & multi-language support

- Chat support

- Push notifications

Merchant Panel Features

- Log in to an interactive dashboard

- Add/manage products

- Create/edit profile

- Account verification via pin, pattern, and Face ID

- Manage customers

- Add promotional offers & discounts

- Offer loyalty points and rewards

- Manage staff and employees

- POS integration

- Payment link generation

Admin Panel Features

- QR code generation

- Manage users & merchants/vendors

- Real-time analytics

- Enhance the app’s security

- Reporting & auditing

- User and merchant data control

- Transaction management

- App support and maintenance

- Dashboard management

- Manage offers

Also Read: A Comprehensive Guide To Create Mobile App

Step-By-Step Guide for Digital Wallet App Development

1. Discovery Phase

The initial phase of software development is commonly known as the discovery phase or scoping phase. It involves a collaborative effort among the app development company, guided by Project Management, to determine the technical requirements necessary to align with the business model of the proposed idea.

This phase helps to facilitate a better understanding of the complexities involved in the solution, enabling each team member to engage effectively with the appropriate technology stacks.

The mobile app development discovery phase comprises several key activities requiring high professionalism and attention to detail. These activities include:

-

Comprehending the Mobile App Idea

The business analyst and project manager will meet with the client to comprehensively understand their mobile app idea, including its unique selling proposition. Detailed meeting notes are then shared with other team members to ensure everyone is on the same page.

-

Conducting Extensive Research on Target Users

Conducting thorough research on the preferences and behaviors of the target users is crucial in guiding the UI/UX designer on appropriate design elements.

-

Creating a Comprehensive Project Workflow

Creating a well-defined project workflow is essential in establishing the sequence of tasks required to achieve the expected deliverable. The CTO or tech lead takes responsibility for determining the features and functionalities necessary to bring the project to fruition.

-

Developing a Detailed Blueprint

A blueprint outlines the requirements for successful digital wallet development. It also contains all project features, functionalities, milestones, and deadlines, serving as an actionable guide for team members, clients, and management.

2. UI/UX Design

It is a critical stage that involves creating an intuitive and visually appealing interface that enhances the user’s experience.

This phase is spearheaded by a skilled UI/UX designer responsible for crafting mobile app design services that capture every icon, button, and software feature. The resultant design is a blueprint for the mobile developers’ coding process, ensuring the final product meets the expected standards.

Upon completing the design phase, the development team will pass deliverables to the next step, including a UI design tailored for different operating systems and a UX wireframe.

3. Development and Testing

The development and testing phase of mobile wallet app creation represents the most technical facet of the process.

The success of this phase is determined by several factors, including the quality of the UI/UX design, the technology stacks employed, and, most importantly, the skill set of the mobile wallet app developers involved.

The outcome of this phase depends on the overall goal of the development project, with the final deliverable being either an MVP (minimum viable product) or a fully-fledged app, depending on the requirements and specifications of the project.

4. eWallet Application Launch

This step involves hosting the product on popular platforms such as Google Play Store and App Store. It allows your crypto wallet app to be accessible to users for download onto their respective OS.

5. Maintenance and Support

Product maintenance refers to the ongoing process of keeping your mWallet app updated, active, and free of bugs and errors while ensuring it remains valuable for its intended purpose.

Furthermore, maintaining the app involves soliciting user feedback to identify improvement areas. You can hire mobile app developers to make necessary adjustments to enhance the user experience and ensure continued satisfaction with the product.

Technology Stack For Digital Wallet App Development

| Backend | Laravel, NodeJS, Java, etc. |

| Frontend | Kotlin, Swift, CSS, Bootstrap, HTML 5, Vue.js, React.js, etc. |

| Database | MongoDB, Apache Cassandra, HBase, MySQL, Postgres, etc. |

| Framework | React Native, Flutter, etc. |

| QR Code Scanning | ByteScout BarCode, ZBar Code Reader, etc. |

| Analytics: | Amazon Kinesis, Apache Kafka, Spark, Flink, etc. |

| Cloud Services | Google Cloud, Azure, Salesforce, AWS, etc. |

| Push Notifications | Amazon SNS, Firebase Cloud Messaging, etc. |

| Geolocation | Google Maps API |

| Payment Gateways | PayPal, Stripe, Braintree, QuickPay, etc. |

Security Compliance For Digital Wallet Application

When creating a digital wallet app, you must consider various security compliance to protect users’ personal and financial data. These considerations include the following:

1. Compliance With Data Privacy Regulations:

Digital wallet app developers must comply with relevant data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

2. Secure Login And Authentication:

The app should use strong encryption to protect user credentials, passwords, and other sensitive information and implement multifactor authentication for an additional layer of security.

3. Secure Data Transmission:

The app must use secure communication channels such as SSL/TLS to encrypt all data transmissions between the app and the server.

4. Protection Against Fraud:

Digital wallet app development should include features that detect and prevent fraudulent activities such as unauthorized access, transaction monitoring, and suspicious activity reporting.

5. Secure Data Storage:

The mWallet app should securely store user data and financial information, such as credit card details, using secure storage methods such as encryption and hashing.

6. Compliance with Payment Card Industry Data Security Standards (PCI-DSS):

The application must comply with PCI-DSS standards to ensure secure credit and debit card information processing.

7. Regular Security Audits And Updates:

The app should undergo regular security audits to identify vulnerabilities and implement timely security updates.

By considering these security compliance needs during developing a digital wallet app, a crypto wallet app development company can create a secure and reliable product that instills confidence in its users.

Top 6 Popular Digital Wallet Apps for Online Transaction

Apple Pay

Apple Pay is a popular digital wallet by Apple Inc., enabling transactions on iPhone, iPad, Apple Watch, Mac, or on the web via Safari. This wallet is available on devices sold by Apple only.

An iOS app development company can integrate Apple Pay into your iOS app to facilitate direct payment via Siri or Messenger. Thus, it can be easily used to send and receive payments from other users or pay for in-app purchases.

It launches “tap to pay” transactions via near field communications (NFC) chip to enable wireless communication with point-of-sale systems.

Users can add twelve cards on iPhone 8 and later devices. They can also add store cards, movie tickets, coupons, rewards cards, transit cards, and student ID cards to their wallet and process services like credit or debit cards.

Google Pay

Google Pay is one of the most-used digital wallet apps offering a better user experience by facilitating fast and easy purchases on mobile devices through tap and pay. Also, it supports secure transactions as it does not share the actual credit or debit card number during payment; instead, a virtual account.

Some of the new features in Google Pay are split bills and tracking group expenses to settle an easy payment among your group members.

In mobile payment app development, merchants have an essential role. Google Pay provides many benefits for them, such as easy integration via Google Pay API and faster and easier checkouts.

It does not charge any extra payment to the merchants to execute customer payments. Also, it completes the whole checkout process within the app without redirecting the customer to any third-party application.

Moreover, its card tokenization process ensures secure transactions, which reduce risks and fraudulent activities, helping you gain customer loyalty and drive more sales.

PayPal

PayPal facilitates online transactions among different parties, individuals, or between a business and an individual. It offers low-cost services and is trusted worldwide as one of the safest mediums to conduct online payment.

It supports ACH (Automated Clearing House) payment processing, facilitating automatic and electronic transactions between parties. It provides features like interactive online payment platforms, including payment tracking, payment scheduling, split billing, etc.

PayPal maintains a secure network with data protection, a vulnerability management program, and access control implementation. Also, it supports Data Tokenization to provide safety to your sensitive data, and Two-Factor Authentication adds an extra security layer.

Moreover, it also benefits developers for money transfer app development with customization features and seamless integration with merchant’s accounting software, eCommerce platforms, and ERP systems.

Amazon Pay

Amazon’s digital wallet allows its customers worldwide to pay for products and services using their Amazon accounts. It is a cloud-hosted payment gateway compatible with some popular eCommerce platforms for integration like Shopify, PrestaShop, OpenCart, and 3DCart.

Amazon Pay is an excellent Wallet for merchants as it offers all payment methods, such as UPI, credit and debit cards, EMIs, and a pay-later facility. Also, it is supported on multiple devices, including Web, iOS, Android, and Desktop.

You can create an Amazon Seller account and embed a plug-in or code to add Amazon Pay to your eCommerce platform. It enables merchants to offer various benefits to customers like digital bills, discounts, and voice-based payments.

Trust Wallet

Cryptocurrency wallets working on Blockchain technology are growing significantly. According to Grand View Research, In August 2022, worldwide crypto wallet users grew to 84.02 million from 76.32 million in August 2021.

Trust Wallet is a decentralized crypto wallet where you can transact and store cryptocurrencies like Bitcoin, Ethereum, Tron, and Litecoin, including several ERC20, BEP20, and ERC721 tokens. It also provides a safe and secure user experience for trading NFTs.

A cryptocurrency wallet app development company can scrutinize the features of Trust Wallet like effortlessly buying cryptos using a credit card, easy access to the latest DApps and DeFi platforms via WalletConnect, and fast and secure multi-crypto wallet support.

Moreover, it offers a safe and secure platform to store private keys on your device, and the transaction flow is perfect for trading on different crypto assets.

Binance

Binance is one of the well-known examples of cryptocurrency wallets that offer the best-centralized exchanges.

Since it is a centralized wallet, the decision-making authority remains at a particular end within the system. Centralized crypto exchanges hold customers’ private keys, unlike decentralized exchanges, which provide ownership to the users of their assets.

It reflects the traditional market financial products and offers user-friendly services; therefore, the users easily understand it.

Binance is expanding its cryptocurrency wallet development services to the decentralized ecosystem with its project Binance chain.

What is the Cost of a Digital Wallet App Development?

Digital wallet app development cost relies on various parameters like features, business, and the type of services it provides. The eWallet app development cost and time might vary based on the features and functionalities of the app. Also, the development style and stages affect the price.

Thus, it would be best if you consider multiple factors to estimate the average digital wallet mobile app development cost.

- The platform on which your digital wallet is built.

- App’s features complexity will also determine the development price.

- The technology stack and tools to create an eWallet.

- The app’s UI/UX is also the development cost determining factor.

- Additional features and screens will increase the app size and cost you more.

- App testing and post-app launch maintenance and support facilities.

- App developers’ location and team size will decide the price of their services.

On average, the price to create a digital wallet on Android may range between $20,000 and $50,000 (and more with additional features). On the iOS platform, this cost may range from $30,000 to $60,000 (and more with advanced features).

Conclusion

eWallets have reformed the market with much simpler and quicker payment solutions. As this market is expected to grow, this might be the best time to invest in digital wallet app development ideas. Mobile wallet app development consists of several stages and procedures, from an app idea to the initial working version.

The digital wallet app market is projected to reach a net worth of $750.3 billion by 2028, with a large audience using these apps for paying in online and offline stores, bill payments, top-up accounts, etc. Therefore, it is best to partner with a development company to bring your ideal eWallet into execution.

Our Expertise in Creating Digital Wallet Applications

SparxIT offers complete digital wallet app development services with the full-scale creation of an eWallet. Our digital wallet solutions are secure and scalable, developed with regular monitoring and testing networks.

Our key to success in digital wallet app development is to keep the business’s needs at the forefront of everything we do. By doing so, we can create an app like PayPal that meets the market’s demands and enhances your users’ lives by offering them a seamless and secure financial experience.

Contact us now to learn more about how we can help you build the digital wallet app of your dreams.

If you have any doubts, feel free to drop a comment.

Frequently Asked Questions

-

How can a digital wallet application benefit my business?

A digital wallet app can benefit your business in several ways. It provides customers with a convenient and secure payment option, increasing customer engagement and loyalty. It also reduces transaction fees compared to traditional payment methods.

-

How can I make my eWallet app stand out from the competition?

If you want to make your eWallet app stand out, it’s crucial to focus on the user experience and offer unique features that other apps do not. Furthermore, staying up-to-date with the latest technologies and trends in the industry is essential to ensure your app remains competitive and relevant.

-

How long does it take to build a digital wallet app?

The time it takes to build digital wallet app varies depending on the complexity of the app’s features, the level of security required, and other factors. Generally, a well-designed and robust best digital wallet app can take 4–12 months.

-

Can I integrate my digital wallet app with other payment systems?

Yes, you can integrate your digital wallet app with other payment systems to provide users with various payment options. Working closely with a reliable digital wallet app development agency is essential to ensure seamless integration and proper security measures.

-

How can I market my digital wallet app effectively?

To market your digital wallet app effectively, you must create a detailed marketing strategy that includes social media, email marketing, search engine optimization, and paid advertising. You must focus on user engagement and offer unique features that can help increase user adoption and retention.