Technology is transforming finance with new trends and their use cases. Blockchain turned around the landscapes of the traditional ways of performing financial tasks, making the complete process architecture more independent and credible.

The finance industry is shifting towards the role of a centralized authority validating transactions and other entities. DeFi, an acronym for decentralized finance, has emerged as a transformative terminology that is often seen as an elemental constraint in the future of the economy.

Technologies are tending towards reinventing the conventional economy infrastructure on the foundation of decentralized computing. A report indicates the DeFi market in the world was worth around USD 11.96 billion in 2021 and is projected to grow to approximately USD 232.20 billion by 2030. This means the market will grow at a CAGR of about 42.6% between 2022 and 2030.

For business enthusiasts, the DeFi app Development comes as an opportunity to utilize the potential growth of a decentralized economy.

What is DeFi?

DeFi is a terminology shifting conventional financial processes to the decentralized networks of Blockchain. The use cases of DeFi may have conceptual similarities with that of cryptocurrencies but the former has a wider scope of opportunities.

Among the primary objectives of DeFi is to eliminate the role of intermediaries and put technology at the center of the process.

What Does a DeFi App Do?

DeFi apps act as the resources that we can use to deliver financial services through decentralized computing. These apps provide a publicly accessible infrastructure where anyone can avail of the services without any personal authentication.

DeFi apps provide users the facility to trade cryptocurrencies, lend or borrow funds, buy insurance policies, and a lot more. These applications utilize Smart Contracts as a digital intermediary for flawless and smooth execution of tasks.

Redefining Finance: DeFi vs Traditional Finance Models

Regulatory elements cause a significant distinction between the structure of decentralized finance (DeFi) and traditional finance. There are different sorts of fees charged on regular process segments.

Several things distinguish DeFi from traditional finance.

Let us find out.

-

Independent

With no regulatory institution, DeFi economy is independent. The data is received from and sent to the users directly. It is stored in a Blockchain where no one can alter any piece of information. Migrating data from one DApp to another DApp is fast and simple. A Blockchain development company can help you implement the foundation of these applications and escape any human intervention, so you need no papers or authority signatures to make your financial decisions.

-

Transparent

The Blockchain development community can review the code, detect and report bugs in DeFi applications. You can view the interaction between accounts. Since every user account is shown pseudonymous by default, user privacy is not hampered.

-

Availability

DeFi app services are made accessible to everyone having an internet connection. Decentralization is all about creating independent service resources.

-

Interoperable

DeFi apps can run across several Blockchain frameworks, and these applications showcase high compatibility with other DeFi apps.

Navigating the Dynamic Landscape of the DeFi Market

DeFi economy is still evolving and stretching its arms across different applications. A staggering increase of 50% in Q1 of 2021 in the userbase has benefitted sectors adopting DeFi.

Decentralized exchange (DEX) is a premier use case of DeFi which is growing at an unprecedented pace.

The transformative DeFi apps have also raised serious concern among a section of business experts who put questions on the support system. They ask who will be culpable in case of financial crimes in an independent, borderless yet encrypted platform like DeFi app.

Smart Contracts works on the concept of ‘code is law’. Some users have also raised concerns about conditions where there would be a malfunctioning across the platform.

Crucial Functionalities of Decentralized Finance(DeFi)

Alongside being decentralized and independent, DeFi applications are used to execute a variety of operations. The use cases of DeFi focus on finding transformative alternatives for traditional finance processes.

Let us explore the functions of DeFi.

1. Stablecoins

As the name suggests, Stablecoins relates to stable or nearly stable volatility in DeFi economy. One of the most risk-prone characteristics of any cryptocurrency is that it exhibits high volatility, which keeps the investors in suspicion if it is a worthwhile investment.

Stablecoins are pegged to prices of reserve assets which makes them a revolutionary crypto entity in the market.

2. Tokens

DeFi tokens are mined on a pre-existed Blockchain where they can generally acquire the name of a native Blockchain. Moreover, they can also be pegged to an underlying asset such as gold, fiat currency, etc.

3. Wallets

Cryptocurrency is at such a nascent stage that it requires a central authority like a digital wallet. These digital wallets would hold the key when cryptocurrencies are exchanged. One can argue how a third party is still intermediating in a distributed and decentralized process architecture.

With DeFi wallet, users can always retain crypto coins but remain responsible for private keys, and they cannot access them without a private key. Unlike a centralized cryptocurrency, you cannot request new keys when lost, which we could do with the passwords.

4. Liquidity Mining or Yield Farming

The process of liquidity mining or yield farming uses cryptocurrencies to provide liquidity. A decentralized exchange (DEX) uses Automatic Market Marker (AMM) to regulate trading. Users can swap tokens to trade cryptos in the liquidity pool and earn passive incomes.

A yield farming app development company can help you build a robust application where users can easily do liquidity mining.

5. Staking

Staking involves the utilization of idle coins to enhance computation energy for validating cryptographic transactions through the best staking platform. The process of staking is based on the proof-of-stake concept, which emphasizes ownership stake than work.

6. Exchange

DeFi exchange apps allow users to trade cryptocurrencies without the participation of a third-party intermediary. These apps utilize Smart Contracts to initiate direct and peer-to-peer trading.

7. Lending & Borrowing

Lending and borrowing are two popular finance processes. Since DeFi is creating aplenty of alternatives for traditional finance, DeFi lending & borrowing apps are one more kind. Smart Contracts act as a technological intermediary in these apps, ensuring that the conditions are followed by both the borrowers and lenders.

8. Insurance

DeFi insurance apps work on a risk or profit-sharing phenomenon where either you earn, or you lose everything. These apps invite investors to create an investment pool that tends to provide coverage to the users of certain DeFi insurance apps from risks related to cryptocurrencies.

Your DeFi Idea Needs Us. Discuss Your Plan Now.

An evolving Blockchain app development infrastructure is leading the market towards futuristic opportunities for investments. There can be many more use cases that we may explore as the dynamics of DeFi reaches the next level.

Example of Top 7 DeFi Apps

When we talk about the transformative economy trends these days, we always put DApp development, NFT Marketplace development, or even cryptocurrency trading app development among the primary use cases. Still, there is a lot more than decentralized computing is offering to the world.

In a growing DeFi app market, you need to be competitive, innovative, and technologically aware.

Understanding your competitors can be the simplest way to identify the ongoing trends of the market for early investors of the DeFi app development market.

Let us explore the seven most popular DeFi apps.

-

Uniswap

Founded in November 2018, Uniswap is a decentralized crypto trading platform. It uses Smart Contracts called Automated Market Makers (AMM) to manage exchanges. The Uniswap protocol determines the token prices by analyzing liquidity for involved tokens.

-

Maker

Maker is a collateral-based and decentralized credit platform. Users can borrow Dai, a Stablecoin pegging value to USD, with debt up to 66% of collaterals. The users open vaults to lock in collaterals such as ETH or BAT coins. The total value locked in the Maker platform reached $9.82 billion by May 24, 2022.

-

Aave

Aave is a decentralized liquidity protocol. It provides a features safety module, a liquidity pool designated to allow users to invest more tokens to earn and contribute in making crucial calls related to the overall functioning of the platform.

The platform lends money on over-collateralization where the value of collaterals needs to be higher than the value of the loan failing which can lead to liquidation of loans.

-

Curve

Launched in 2020, Curve (CRV) is a decentralized exchange platform that supports stability. The platform provides the facility to trade tokens at low fees and slippage by accommodating liquidity pools.

-

Convex

Convex finance is a platform rewarding CRV token holders and liquidity providers. Users can deposit exchange their CRV tokens with cvxCRV tokens.

-

Flexa

Flexa is a decentralized payment system where users can pay using a wide range of cryptocurrencies i.e. ERC20 tokens, Stablecoins, and reward points. It supports dozens of currencies yet engage in simple and fast processing of payments.

-

dYdX

dYdX is a non-custodial decentralized exchange platform where users can initiate fast, secure, and transparent trading. The platform uses Smart Contracts to stamp out a central intermediary.

Decoding the Blueprint: The Structure of DeFi App Development

Now that we understand various components of DeFi economy, it is time to know how we make a DApp become the medium to provide the intended services.

Create Token

Currency is an integral part of any finance app, having your own currency is something blockchain facilitates. For DeFi, an experienced DeFi token development company can create crypto tokens, or they can integrate them with other existing coins/tokens to facilitate purchase, exchange, or other operations.

Wallet Integration

Wallets provide a DeFi app that platform to store private keys and utilize tokens for different operations. Wallet ensures users that they can store currency and they can use it to perform operations on the Defi platform. DeFi wallet development ensures secure and authenticated transactions.

Browsers and application infrastructure interact directly with the wallets e.g., MetaMask, Trust, etc.

Setting Up Frontend

DeFi users communicate through the frontend of the applications which implicitly interacts with the backend APIs. This step will ensure you create an interface to access all functionalities within the DeFi app through Smart Contracts.

Smart Contracts

Smart Contracts are a self-executing set of codes that indulges in dedicated functionalities. This set of codes operates the execution of conditions that need to be followed upon transactions. DeFi smart contract development helps you can set up your own rules and regulations for the proper functioning of your Defi App.

Integration With Backend

Once Smart Contracts are created, they can be integrated with a Backend API or directly with your frontend. Through this process, we integrate both the frontend and backend of the application into the Blockchain.

Technology Stack to Create a DeFi App

| Smart Contracts Languages | Solidity, Rust, Vyper |

| Backend API Libraries | Infura, Alchemy, Moralis, Nodesmith, BlockCypher |

| Development Frameworks | Truffle, Hardhat, Brownie |

| Programming Languages | JavaScript, Python, Go |

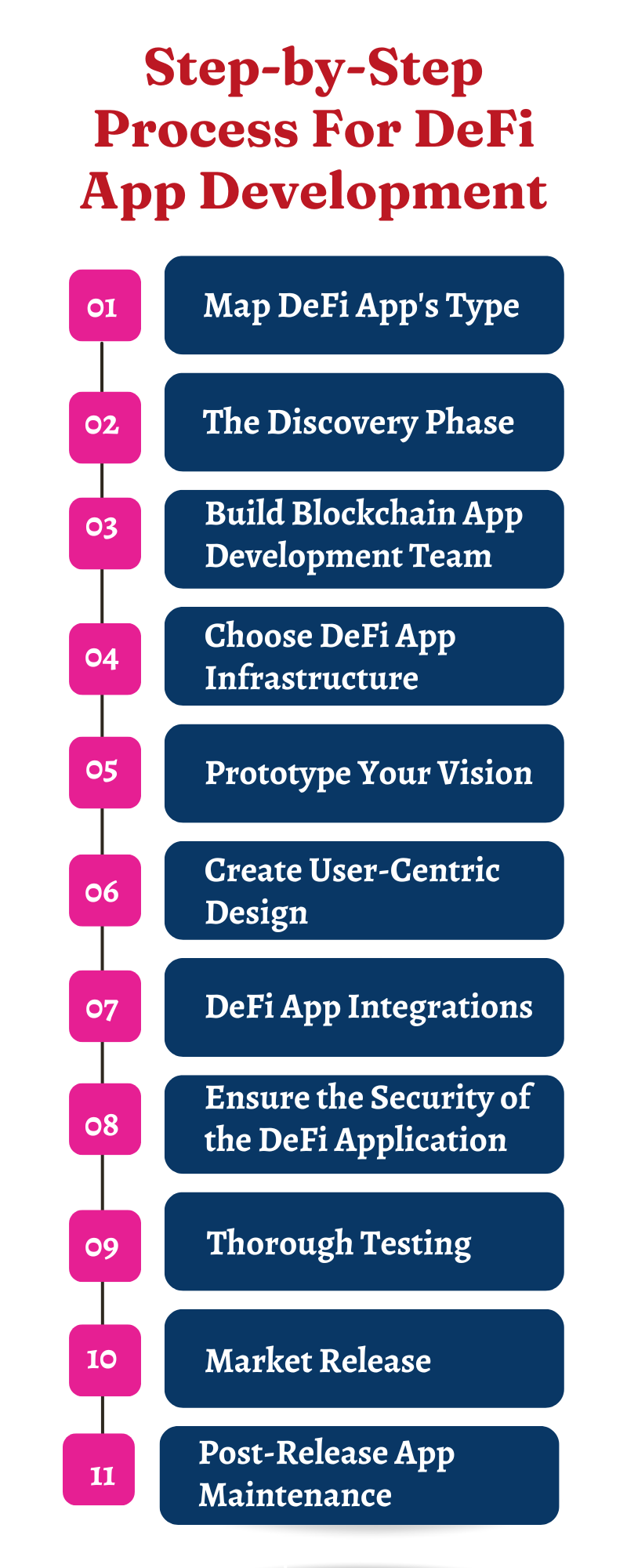

How to Develop a DeFi App? (Process Explained)

Developing a DeFi app opens up a world of opportunities in the rapidly growing decentralized finance sector. By creating a Decentralized app, you can empower users with financial autonomy, transparency, and seamless access to various innovative financial services.

1. Map DeFi App’s Type

If you want to develop a successful DeFi app, it is crucial to map out its type precisely. It involves identifying the specific niche or functionality your app aims to provide within the decentralized finance landscape.

Whether it’s a decentralized exchange app development, lending platform, yield farming protocol, or token staking app, understanding your app’s type will help guide the development process and ensure that it meets your target audience’s unique needs and preferences.

2. The Discovery Phase

During this phase, extensive research is conducted to deeply understand user needs, market trends, and potential competitors. Through market analysis and competitor benchmarking, valuable insights are gathered to shape the app’s features and functionalities.

The discovery process sets the foundation for a successful development journey, ensuring that your DeFi blockchain development meets the expectations of its intended users.

3. Build Blockchain App Development Team

Blockchain development for DeFi requires experienced and skilled professionals. This team should consist of proficient blockchain developers, smart contract developers, UX/UI designers, and quality assurance professionals.

A strong team will bring their expertise and creativity to the table, working synergistically to create robust and innovative DeFi development services that stand out in the market.

4. Choose DeFi App Infrastructure

Selecting the proper DeFi app infrastructure is a critical decision that lays the groundwork for your project’s success. Consider scalability, security, interoperability, and community support when choosing blockchain-based DeFi trading platforms.

Ethereum, Binance Smart Chain, and Polkadot are popular options, each with its own advantages. Additionally, evaluate the available tools, frameworks, and libraries to accelerate development and streamline integration with DeFi protocols.

5. Prototype Your Vision

Prototyping your DeFi app is pivotal in transforming your vision into a tangible reality. Creating prototypes allows you to visualize and test your app’s core functionalities, user interface, and user experience before proceeding with full-scale DeFi app development.

It is an iterative process that allows for valuable feedback and refinement, ensuring that your app aligns with your original vision and meets the needs of your target users.

6. Design a User-Centric & Intuitive App Interface

You can ensure seamless navigation, clear information presentation, and an aesthetically pleasing design by prioritizing user needs and preferences. User-friendly features such as easy-to-understand menus, intuitive controls, and personalized settings enhance engagement and satisfaction.

Conducting user testing and incorporating feedback throughout the design process guarantees that your DeFi exchange platform development gets a flawless user experience, fostering customer loyalty.

7. Add Essential DeFi App Integrations

A DeFi app development services provider can easily add essential integrations to your DeFi app. Integrations are vital for expanding the app’s functionality and providing users with a seamless experience.

Integrating with popular decentralized exchanges (DEXs), lending protocols, oracles, and wallet providers enhances the versatility and accessibility of your app. It allows users to connect and interact with different DeFi platforms, access liquidity, and securely manage their assets.

8. Ensure the Security of the DeFi Application

When you implement robust security measures such as smart contract auditing, code reviews, and vulnerability assessments helps identify and mitigate potential vulnerabilities or loopholes.

Additionally, integrating multi-factor authentication, encryption protocols, and secure critical management systems enhances the protection of user data and prevents unauthorized access. Prompt response to any security incidents is crucial to maintaining the integrity and resilience of your on-demand DeFi wallet development.

9. Test Your Decentralized Finance App

A comprehensive testing includes unit testing, integration testing, and end-to-end testing. It helps identify and address any bugs, glitches, or vulnerabilities. Test scenarios should encompass user interactions, transaction processing, and edge cases.

Additionally, stress testing can assess the app’s ability to handle high loads and maintain stability. Rigorous testing minimizes risks And ensures your DeFi wallet app development operates flawlessly in real-world conditions.

10. Launch the App in the Market

Launching your app involves a strategic marketing plan, including creating a compelling launch campaign, leveraging social media platforms, and collaborating with influencers or industry partners. Build anticipation and generate buzz around your app to attract early adopters.

Be prepared to gather user feedback, iterate on features, and address any initial challenges. A successful market launch sets the stage for widespread adoption and positions your DeFi app for long-term success in the competitive landscape.

11. Post-Release App Maintenance

Regular updates and bug fixes address issues after the initial launch, enhancing user experience and satisfaction. Monitoring app performance and analyzing metrics provide valuable insights for ongoing optimization.

Furthermore, staying up-to-date with evolving DeFi protocols and security measures is essential to maintain the app’s integrity and safeguard user assets. A proactive maintenance plan ensures your DeFi wallet development solutions remain competitive and user-friendly in the dynamic market.

How Much Does It Cost To Build DeFi App?

The cost of building DeFi apps can swing wildly, influenced by many factors such as features, platforms, tech stack, and the engagement model for your DeFi development team. For instance, developing your app would take more time and resources if you need a smart contract to manage numerous assets and currencies. It is so because it has more functions and variables than other kinds of applications.

Simple applications can be created for $7,000 to $15,000, while complex apps with advanced features cost anywhere from $25,000 to $150,000. The number of DeFi developers working on your project and the number of hours they put in impact the costs. DeFi software costs more than conventional mobile apps since they require more specialized resources and abilities, like Web3 API, Solidity coding, and smart contracts development.

The Future of Finance Featuring DeFi Applications

Although traditional finance has evolved significantly, the role of centralized authority has never been replaced. The hypothesis of the future of finance featuring DeFi comes with arguments debating that even the so-called decentralized finance would use Smart Contracts development techniques to set up a technological intermediary.

Despite an exceptional surge in the growth of DeFi apps, one can say that there is still a lot to address when it comes to DApp development.

How Can SparxIT Assist in Your DeFi App Development Journey?

From discovery, integration, storage to product development, you need a DeFi development company that creates industry-oriented, feature-packaged, and user-oriented applications conforming to the needs of an advanced decentralized economy.

Our primary DeFi app development services include the following;

- Designing & Integration

- MVP Consultation

- Decentralized Exchange Development

- Smart Contracts

- Wallets Development and Integrations

You can reach out to our DeFi experts to explore more.

Conclusion

Decentralized finance is still in nascent stages, evolving its customer-oriented landscapes and being used in general applications. Despite all security protocols, some experts are still skeptical of the limitations of DeFi apps. However, the DeFi is growing by leaps and bounds, showing no negative impacts on the technological infrastructure of the Blockchain economy. A prominent DeFi development agency is equipped to handle all your DeFi project requirements efficiently.