The net premiums written by insurance agencies in the US aggregated approximately $1.47 trillion in 2022. Gross annuity premiums amounted to $400 billion, compared with $206 billion in life insurance premiums. The insurance industry is enormous and has a massive economic impact. Furthermore, the volume of paperwork and intricate procedures involved in operating insurance businesses are even more staggering. The number of mind-numbing works, clients, and data is increasing rapidly.

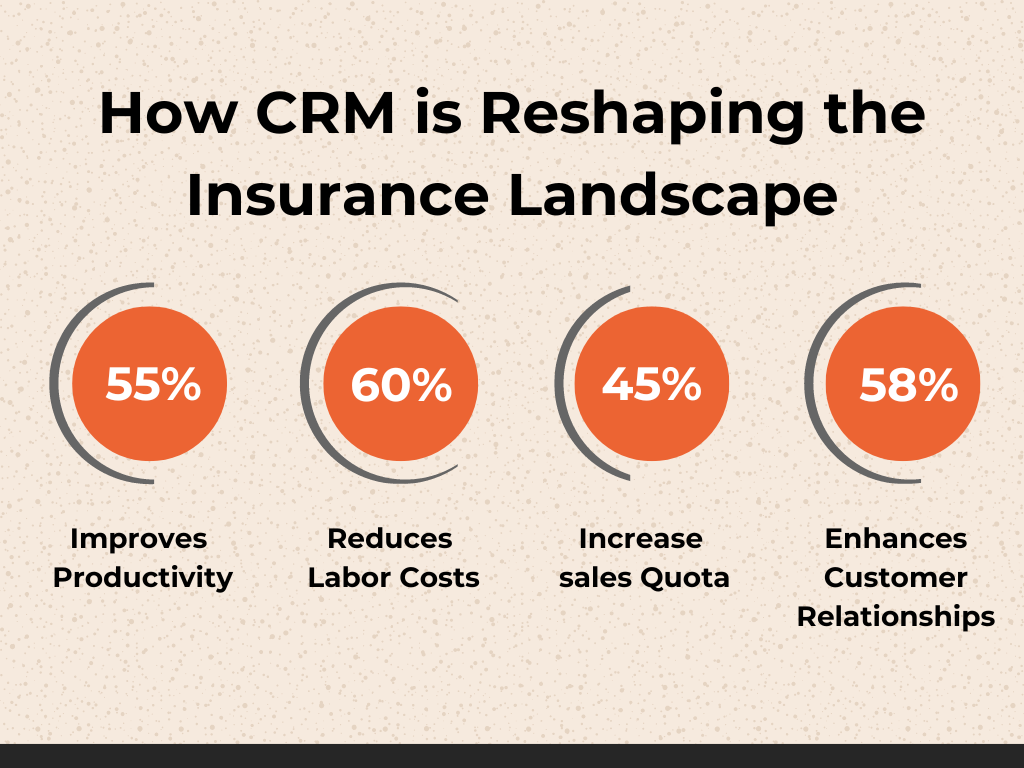

The work above wears down employees and raises the risk of errors, which can harm insurance companies’ reputations. This is where insurance software solutions come into play. It’s a cutting-edge tool actively changing how insurance sales are done today. CRM/ERP development services can assist you in building an insurance software development system for enhanced productivity.

What is Insurance CRM Software?

Insurance CRM software is a unique tool insurance companies utilize to handle client interactions. It consolidates sales funnels, policy information, communication histories, and customer data. Furthermore, AI in mobile app development can also help agents track leads, address policies, and automate communication using insurance CRM solutions, which enhances marketing initiatives.

CRMs for insurance use features like lead management and reporting analytics to improve customer satisfaction, increase sales effectiveness, and spur business expansion. By optimizing engagement and retention, insurers may provide individualized service, spot cross-selling possibilities, and establish enduring connections with policyholders.

Overview of the Zoho Platform

Zoho CRM is a cloud-based customer relationship management (CRM) platform for managing the sales, marketing, and customer support aspects of business-to-business (B2B) and business-to-customer (B2C) engagement strategies.

Zoho CRM for insurance agencies is licensed as a software as a service (SaaS) and can be accessed by prominent web browsers developed for utilization on Linux, Mac OS X, and Windows desktops.

Users can use the Zoho CRM in the insurance industry via a mobile app on Apple’s iPad, iPhone, and Android phones. All sizes of businesses can use Zoho-like CRM Software for reliable sales insights and better customer service.

Addressing Business Hurdles with Customer Relationship Management System

Customer relationship management systems are primarily designed to assist companies in managing their communications with existing and new clients. The technology’s ultimate objective is to enhance and expedite business relationship procedures to spur corporate expansion.

Consequently, you can overcome the following obstacles with the use of efficient insurance agency management software:

-

Fragmented Information

You can contact prospects and customers via text messaging, phone calls, emails, or even the chat feature on your custom insurance CRM solution. Of course, these data fragments and necessary details essential to closing a deal might get overlooked. Insurance agents must have all their crucial data in one place for convenient access, and software for insurance agents can provide just that.

-

Inefficient Workflows

Insurance professionals handle a lot of paperwork and manual data entry. After all, much documentation is needed to manage policy requests, renewals, claims, and quote requests. This slows down operations and inefficiently processes workflows. However, this need not be the case with a document management system.

-

Dropping Retention Rate

You can also be dealing with a decline in customer retention. The failure to build loyalty and communicate with existing clients may cause this issue. You must persistently remind those who have selected you as their insurance provider of the benefits of sticking with you, which is challenging to accomplish without an insurance CRM development.

-

Few Leads and Conversions

It usually takes several interactions before someone expresses interest in what your business has to offer. Similarly, it typically takes multiple communication attempts to turn a prospect into a customer. Therefore, if you need help converting leads into sales, it could be time to build an insurance CRM software like Zoho for your insurance agents and brokers. Thanks to it, they can communicate through various channels and quickly close the deal.

Also Read | Salesforce Development Guide

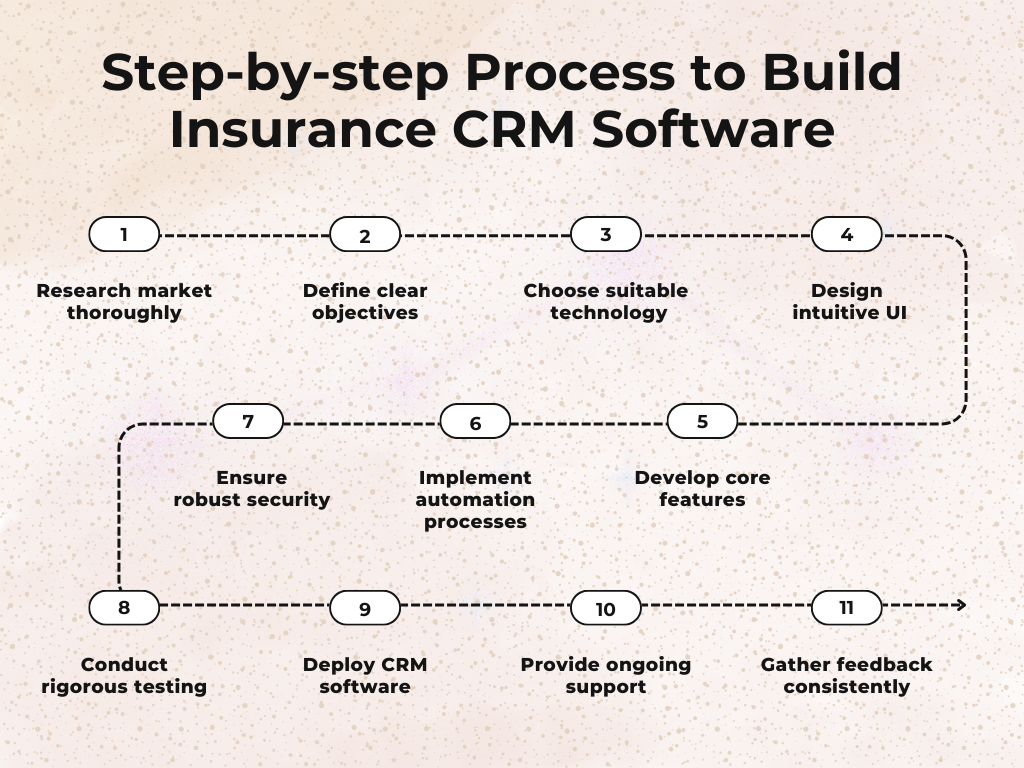

Steps for Building an Insurance CRM Software Solution Like Zoho

Developing custom insurance CRM software like Zoho necessitates careful design and implementation to satisfy the distinct objectives of both insurance businesses and their clients. This customized strategy ensures top performance and smooth integration in the insurance sector. We’ve outlined crucial measures below to ensure a successful implementation.

- Conduct thorough market research

- Define clear objectives

- Select the appropriate technology stack

- Design intuitive user interface (UI)

- Develop core features

- Implement automation features

- Ensure robust security measures

- Conduct rigorous testing

- Deploy the CRM software solution

- Provide training and ongoing support

- Gather feedback for continuous improvement

Now, let’s look at the essential steps to develop Insurance CRM software in detail.

Step 1: Determine Requirements and Goals

Begin by comprehending the precise prerequisites and goals of the insurance CRM software. Determine the essential elements, including tools for communication, policy tracking, client management, and claims processing. Comprehend insurance operations’ procedures and workflows to customize the insurance CRM software solution efficiently.

The following elements must be considered while establishing the specifications and goals for developing custom CRM software.

-

Client Relationship Management

Consider how the CRM solutions for small businesses will handle client data, such as contact information, policy history, communication preferences, and other pertinent Information.

-

Policy Monitoring and Oversight

Choose how CRM development like Zoho will track policies at every stage of their existence, from issuance to endorsements to cancellations. This entails monitoring policy details, rates, coverage limitations, and insurance expiration dates.

-

Claim Processing

Assess how building Insurance management software will manage the claims procedure, including document management, tracking claim status, gathering claim information, and assisting clients, adjusters, and insurers in communication.

-

Communication Channels

Evaluate the communication tools required within the Insurance CRM software like Zoho, including options for messaging, email integration, automated alerts, and document sharing. Consider how these CRM platforms facilitate communication among clients, underwriters, insurance brokers, and other relevant parties.

-

Integration Features

Ascertain whether the CRM software for insurance agents requires integration with other platforms, third-party data sources, accounting software, policy administration systems, or marketing platforms. Effective integration between several functions can improve productivity and data accuracy.

-

Compliance & Security Measures

Verify that the custom CRM software for Insurance companies conforms to data security guidelines and industry rules, including GDPR, HIPAA, and PCI-DSS. Businesses can hire a mobile app development services provider to implement robust security measures to guard sensitive customer data and prevent illegal access or breaches.

Step 2: Select the Right Technology Stack

After determining your needs, you must choose the right technological stack to build an Insurance CRM software. Databases like MySQL or PostgreSQL, programming languages like Python or Java, and frameworks like Django or Spring are standard technologies utilized in CRM development.

Let’s look into these essential considerations —

-

Scalability

As the CRMs in the Insurance industry expand, be sure the selected technology can manage growing data quantities and user traffic.

-

Performance

Choose technologies that deliver the best possible performance to satisfy the demands of real-time data processing and user interactions.

-

Security

Prioritize technology with robust Zoho CRM features to safeguard sensitive client information and adhere to data protection laws.

-

Customization

Select a technology stack that enables customization and flexibility to meet specific processes and business needs.

-

Cost-effectiveness

Consider the entire cost of ownership of the selected technology stack, including license fees, development costs, and recurring maintenance expenditures.

-

Developer Skills

Hire Android app developers to ensure efficient development and support procedures. Business owners can evaluate the availability of competent developer’s knowledge of the chosen technologies and frameworks.

Step 3: Design Intuitive UI/UX

The main advantage of custom insurance app development like Zoho is designing an interactive and user-friendly interface. Customizing the UI can improve user interactions while enabling easy navigation and accessibility.

Remember the following points when creating a user interface for the insurance agency management system—

-

User-Centric Design

Understand the needs and workflows of the sales team through user-centric design. Interfaces should be tailored to tasks to increase efficiency and usability.

-

Easy Navigation

Arrange features and menus logically to make navigating them simple. When building Custom CRM software like Zoho, ensure functions and Information are easily accessible to users.

-

Integration of UX/UI Best Practices

Create a distinct visual hierarchy highlighting essential details and features in CRM for insurance agents. Use typeface, contrast, and color to direct viewers’ attention.

-

Responsive and Adaptive Approach

When building custom insurance CRM software solutions, use responsive and adaptive design. Ensure the interface is responsive to various screens and devices. This provides a consistent user experience across PCs, laptops, tablets, and smartphones.

-

Accessibility

CRM Software for insurance agencies should have an interface considering various user needs. For inclusion and compliance with accessibility standards, consider keyboard navigation, color contrast, text readability, and screen reader compatibility.

-

Customization Options

Users can change the interface as per their preferences and the working methods of the insurance CRM tool. Layout, dashboard, and setting customization are permitted for increased enjoyment and productivity.

Step 4: Build Core Functionality

It means tailoring necessary features and functionalities to the insurance sector’s requirements. Developing customer data management systems, lead creation, and policy management modules are essential.

Insurance CRM software similar to Zoho also requires integrating lead management, customer support, and sales automation technologies. Sales process automation and insurance-specific pipeline management ensure efficient policy renewals and performance monitoring for insurance sales.

Step 5: Incorporate Security Measures

It protects client information, communication routes, and customer interactions within the insurance agency software solutions. Regularly updating security processes reduces possible dangers and vulnerabilities. Furthermore, extensive testing ensures the dependability of these security elements, boosting the system’s integrity and reliability.

Step 6: Conduct Testing and Quality Assurance

Conduct tests and quality assurance to ensure the CRM for insurance brokers is dependable and performing well. Testing is done on various parameters, workflows, and integrations to find and fix any errors or inconsistencies. Furthermore, thorough user acceptability testing involving industry experts improves the system’s performance and user experience.

Step 7: Deployment and Maintenance

Finally, introduce the insurance CRM software like Zoho into operational settings. Provide insurance professionals with thorough training and assistance to ensure a seamless transition to the new system. Your iOS app development services provider can schedule routine maintenance and updates to meet the changing technology needs, regulatory standards, and commercial requirements.

Frequent upgrades ensure data stability and integrity while improving system performance and user experience. Investing in CRM software maintenance helps maintain dependability and efficiency over the long run.

Final Wordings

The allure of digital transformation is not exclusive to the insurance industry. First in line is the automation of management procedures. Creating custom insurance CRM software solutions is a viable and reliable approach to improving efficiency, saving costs, reducing workloads, and satisfying clients. As a leading end-to-end software development services provider, we can assist you create a custom CRM solution for your insurance company.

At SparxIT, our commitment to providing insightful advice stems from our deep involvement in the CRM industry. Our expertise lies in building Insurance CRM Software like Zoho, which guides startups, enterprises, and innovators toward the optimal choice between proprietary software and market-ready CRM solutions.