As per the latest data available as of March 29, 2022, lending was the highest valued segment on Ethereum Blockchain.

Crypto lending apps have emerged as a popular technology asset, following the traditional finance service delivery model in a decentralized framework. The lending process in these apps is powered by the Smart Contracts written by Blockchain developers.

Flash loans can be an ideal alternative for availing loans without any upfront collateral. With no significant limitations and a long authentication process, you can easily avail of loans.

This blog post will provide you with a quick and comprehensive understanding of what flash loans are, how the DeFi space is utilizing these financial resources, how one can repay their loan amounts and lots of other queries.

What are Flash Loans?

As the names suggest, flash loans are fast.

The user transactions are managed in the form of a Smart Contract or a unique user address.

Flash loans are an effective way of availing collateral-free crypto loans. Borrowers can access single or multiple reserves, depending upon options available for flash loans.

Flash loans are allowing DeFi investors to leverage an open, stable, and variable position based on supplied collateral in any near situation.

How Do Flash Loans Work?

Flash loans are fast as the process of borrowing and repaying amounts can be accomplished within seconds. Smart Contracts set the foundation of protocols for incorporating Blockchain algorithms and generating desired results faster and smoother.

Flash loans yield a significant amount of profits that may include a minimal surcharge of 0.09%.

In order to avail of flash loans, one can follow the below-mentioned process;

- You can apply for a flash loan on Aave or Uniswap.

- Borrowers create and implement the logic for exchanging assets through sales, DEX purchases, trades, etc.

The loan transaction will be paused, and the platform will send the amount back to the lender’s account, in case:

- There is a delay in capital repayment.

- Profit value is 0.

Flash loans are applicable for implementing DeFi protocols based on Ethereum and Polygon Chain.

Flash loans were initially launched for a tech-savvy audience. However, with the technological evolution and simplification of programming tools into less-code or no-code tools, users with basic coding skills can also join in performing flash loans.

Popular Use Cases of Flash Loans

Arbitrage

In the process of arbitrage trading, traders buy assets on one platform and sell them on another platform.

Users exploit the price difference between two cryptocurrency exchange platforms. They would buy a token at lower price at exchange A and sell it back at exchange B at higher pricing.

Flash loans can provide these users the facility to avail loans within seconds, exploit the price difference, invest the amount in purchasing tokens, and repay the loan amount.

So, how does this work?

We can understand the entire process of utilizing flash loans in arbitrage trading through the below-mentioned pointers.

- Get loans on Aave.

- Buy digital assets like LINK using the loan amount on DeFi trading platforms like Uniswap.

- Sell assets from a higher pricing difference.

- Repay the amount with interest back to the flash loan platform.

Debt Refinancing

This process refers to the traditional DeFi loan process and borrowers avail of loans to compare interest rates with other DeFi lending platforms. By availing of flash loans from a DeFi lending platform with a lower rate of interest, borrowers can pay off interests with higher rates.

Once the borrower completes the cycle, they would end up having affordable interest rates in the end.

Collateral Swaps

Swapping of collaterals has simplified the process of availing of loans. DeFi borrowers can now switch collaterals between two different lending accounts on two different lending platforms. They can pay back the first flash loans by liquifying collaterals of another flash loan.

Liquidation

The health factor is the numeric representation of how securely a DeFi platform can keep your assets. Borrowers can only liquidate their assets if the health factor is 1 or more.

Borrowers whose holdings’ health factor was more than 1 could only liquidate their assets.

The lending service provider would earn service charges and a liquidation bonus with a liquidation threshold of up to 50%.

Repayment in Flash Loans

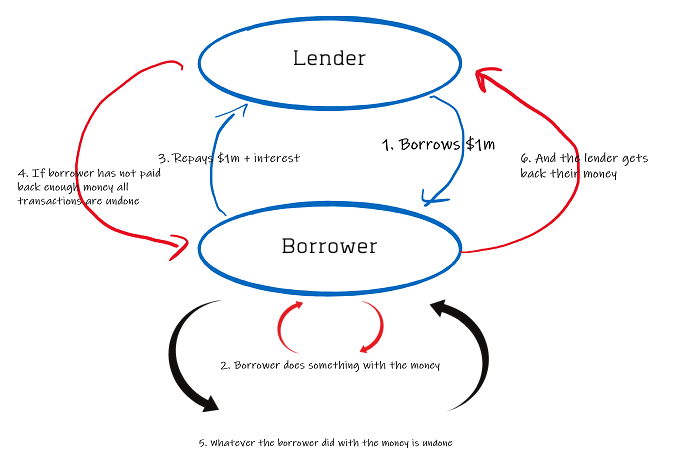

Flash loans occur atop DeFi lending platforms like Aave, Uniswap, or SushiSwap. These loans are paid back in the same transaction blocks as they are initiated. In case the borrower fails to pay back on time, the entire transaction block reverts with the implementation of EIP140.

The borrower can repay the loan amount, and earn profit post payment of a 0.09% fee.

The amount and premium required to pay back the loan is automatically pulled and does not require the lenders to manually transfer the funds.

If a user fails to repay the loan, the entire transaction is reverted in the same transaction block.

EIP140 is an Ethereum Improvement Proposal using which the developers can call REVERT function and stop or revert the current exchange state.

What Are We Doing in the Flash Loans Space?

Using Aave Liquidity Protocol to Create a Flash Loan Bot

From availing flash loans to investing the amount and repaying the loan, the entire process is accomplished within seconds.

A bot helps the lenders and businesses to accomplish the task within a fraction of seconds.

As a leading DeFi development company, we were given an opportunity to work on a bot that would automate the above-discussed DeFi lending processes, i.e., arbitrage trading, debt refinancing, liquidation and collateral swaps.

Our flash loan bot will help the borrowers to identify the health factor and know whether they can liquidate their assets.

We created Smart Contracts with the protocols determined. It demonstrated the current exchange value, collateral value, and exchange price.

The set of conditions has been deployed on Etherscan, a block explorer and analytics platform.

Also Read | Ultimate Guide to DeFi App Development

Conclusion

Flash loans are revolutionizing the traditional loan infrastructure by eliminating the role of centralized intermediaries and commonly required entities such as proof of income, reserves, and collateral.

Increased access to DeFi development services has transformed how DeFi enthusiasts are realizing their dreams of creating potential flash loan apps.

Stay tuned for more information.

We are currently exploring and creating innovative solutions in the DeFi space. If you have a transformative DeFi app idea, you can reach out to our experts now.