With 169.3 million mobile banking users, 64.9% of the US population uses mobile banking, according to a third-party website.

Mobile apps are making banking more straightforward, more accessible, and transparent.

Such apps have become valuable tools for customers, banking, and financial institutions.

White-label app developers and distributors are creating such apps and earning revenues.

You may face several challenges while developing a user-centric, compatible, and risk-free banking application. You need an innovative and streamlined mobile app development process to achieve your project goals effectively.

Let us explore the complete FinTech app development guide.

Why Should Businesses Develop a Banking App in 2023?

Customer convenience is one of many reasons you build a highly functional product. A passionate business leader considers the business aspects of the app developed.

-

High ROI

It takes in-depth market research, time, money, and resources to turn a mobile banking app idea into reality. Every business expects good returns on their investments in developing a mobile banking app.

A mobile banking app owner can expect results in various ways. It can either be in terms of more user engagement, expanded customer base, increased revenues, or augmented market credibility.

There are several case studies of leading banking institutions that have achieved positive results by developing and onboarding mobile banking apps in their processes.

-

Rich Customer Experience

As per the data collected by ThinkWithGoogle, 6 out of 10 respondents accepted using a FinTech app to manage their financial transactions.

People are shifting to digitized banking resources as they are more accessible and save their time and effort.

Banks have the opportunity to help their customers accomplish different financial activities fast and simply.

-

Augmented Marketing Channels

Mobile banking apps have provided an opportunity to reach out to customers with deals and offers of their interest more interactively. Launching such campaigns and getting an adequate customer response is more effortless.

Discuss Your Mobile Banking App Idea Now

-

Precise and Paperless

Adapting mobile banking apps to modern-age financial infrastructure has simplified the process by reducing paperwork. With digitized processes, coded law, and better customer engagement, businesses have better clarity of their goals.

-

Accessibility & Availability

Mobile banking has eliminated gaps between banks and their customers by providing a centralized and technology-backed space where they can avail themselves of the services interactively.

What Are the Challenges of Banking App Development?

From creating a solution-oriented product to successfully showcasing it to the right stakeholders, you want your mobile banking app to meet all possible project requirements.

Mobile banking app developers may encounter several challenges while turning a mobile banking app idea into reality.

However, hiring a credible mobile banking app development company can ensure meeting all the project needs mentioned earlier needs.

Business owners face two primary challenges when they create banking app with the help of developers.

-

Security

Since your mobile banking app may need to use user data to fulfill certain functionalities, it might be necessary to feature adequately strong security walls.

To counter security vulnerabilities and make your mobile banking app secure, developers need to utilize the latest security tools. Such packages allow your app to sustain diverse and complex security standards.

-

Compliance

Standard-compliant applications may showcase promising overall app performance and security results. When your application serves a versatile audience from diverse geographical locations, it becomes essential to conform to the compliance and protocols defined by authorized regulators.

Here are some of the popular compliance for FinTech companies that you may consider before developing your mobile banking app:

Bank Secrecy Act (BSA)/Anti-Money Laundering (AML) Regulations

Your mobile banking app must comply with the Bank Secrecy Act (BSA) regulations.

This compliance can restrain the following in a FinTech app:

- Fraudulent activities

- Money laundering

- Suspicious activities

A mobile banking app development company can utilize and implement the DevSecOps approach for developing the application. It is considered a practical and systematic development approach to leverage agility and responsiveness to create robust mobile banking apps.

Gramm-Leach-Bliley Act (GLBA)

This compliance focuses particularly on regulating or controlling the collection or disclosure of private information of the customers. The service provider must also disclose all information-sharing policies and practices of the product.

Fair Credit Reporting Act (FCRA)

This FinTech compliance focuses on protecting customer privacy and information accuracy. Consumer reports created by service providers may include sensitive information that demonstrates character and assets. The compliance restricts the disclosure of sensitive information that may lead to unauthenticated use in employment, housing, or credits.

Money Transmitter License (MTL)

Any enterprises or institutions engaging in monetary transmission must comply with the protocols included in this compliance. Your mobile banking app will be a financial instrument to sell and purchase financial assets.

Money Service Business (MSB)

Per protocols in this compliance, mobile banking app publishers must register the product through the BSA e-filing system. By following this compliance, you can eliminate AML risks and conform to BSA reporting standards.

BitLicense

If you plan to include cryptocurrency exchange features in your mobile banking app, you must comply with the protocols in BitLicense.

A FinTech App Development Company including other virtual currencies in their product should also meet the protocols within BitLicense.

Must-Have Features to Consider For Mobile Banking App Development?

From creating new customers to retaining existing ones, features play a crucial role in defining any mobile app’s success.

Identifying the features your mobile banking app would include can be critical.

But what if we knew for which tasks our customers would use our application?

As per the data in a ThinkWithGoogle report, here are some primary tasks for which a set % of users install and use finance apps.

| User volume (%) | Activity |

| 55 | To engage in easy banking operations |

| 27 | Accomplish purchases |

| 27 | Referrals |

| 21 | Already using such an app and want to switch |

| 19 | View and avail new deals |

| 16 | Limited features on the website |

This data can help you personalize your app as per your potential audience’s needs.

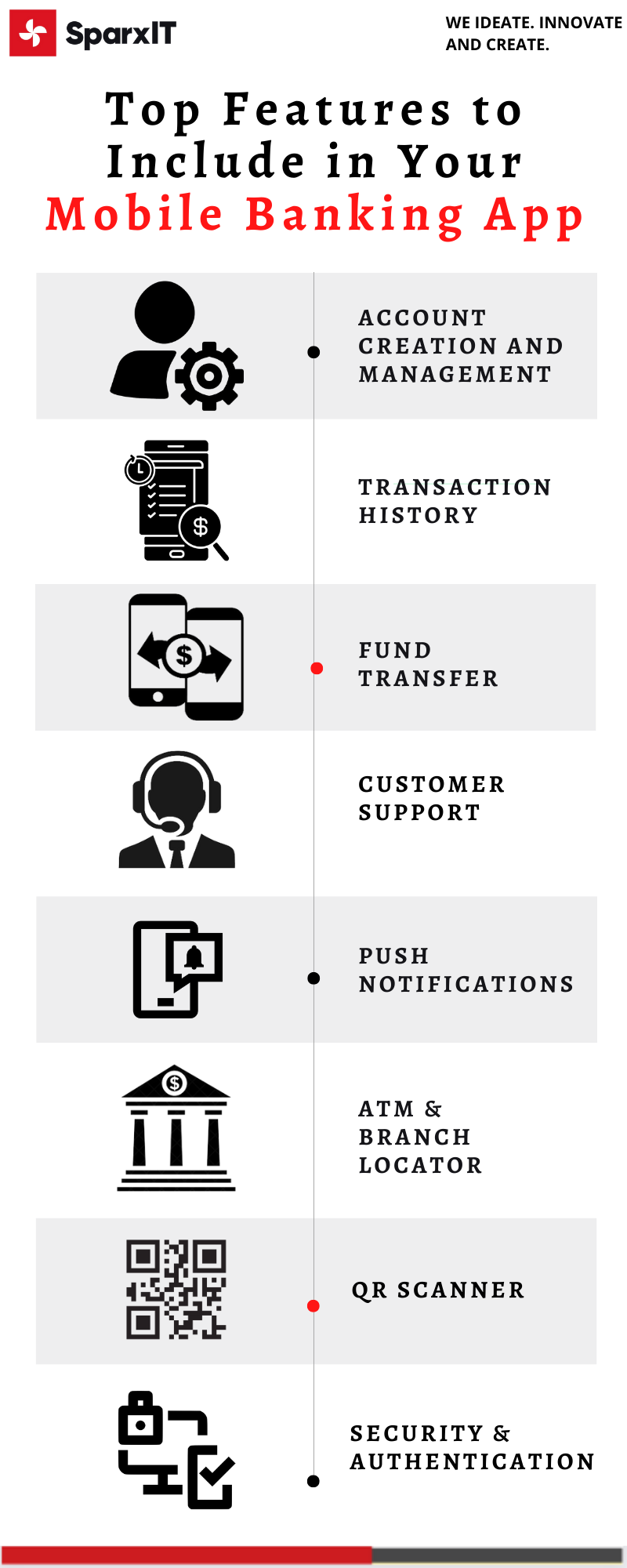

We are listing some of the most popular mobile banking app features you can consider for your project.

-

Account Creation and Management

From creating bank accounts to viewing balances and generating custom statements, customers prefer using mobile banking apps to simplify complex financial operations.

By keeping a user-friendly interface, you can allow your customers to create and manage accounts efficiently.

-

Transaction History

Keeping track of recent transactions is a common and critical feature that every mobile banking app should include. You can allow customers to track transactions between custom data and periodically.

-

Cross-Channel Payments

Customers get a compatible additional payment option by installing a mobile banking app on their smartphones.

-

Fund Transfer

Mobile payments may grow at a staggering CAGR of 29% between 2020 and 2027. Incorporating an interactive fund transfer facility in your mobile app can benefit your business ambitions significantly.

-

Customer Support

By countering their problems timely and effectively, you can become your customers’ favorite. To accomplish this, you would need to create an interactive support infrastructure in your mobile banking app.

-

Push Notifications

Mobile banking apps can use push notifications to send direct updates on individual banking accounts, the latest deals and offers, and app updates.

-

ATM & Branch Locator

By accessing geolocation data, your mobile banking app can track the branch and ATM nearby to your customer’s location.

-

QR Scanner

You can simplify identifying individual user accounts to send and receive payments and enable faster user authentication.

-

Security & Authentication

Technological enhancements are accessible to everyone, regardless of their intentions. Cyberattackers are exploiting these upgrades to create potential threats to customers.

Mobile banking app development companies can create a robust IT infrastructure to encounter any vulnerabilities in the security system. They can utilize tools like multifactor authentication, end-to-end encryption, integrated customer privacy, and transaction monitoring resources to safeguard customer data and other infrastructural resources in your mobile banking app.

How to Create a Mobile Banking App in 2023?

Creating a mobile banking app can be lengthy, complex, costly, time-consuming, and unproductive if you do not plan your project smartly.

How do you get started with a streamlined mobile banking app development process?

It starts with validating your plans with the help of experts.

So, what exactly do these experts do?

This section will provide a comprehensive understanding of where and how to get started in the mobile banking app development process.

-

Discovery

The discovery phase in the mobile app development process focuses on everything that creates a strong foundation of project management and product development goals.

We can categorize the entire discovery phase into different process parts as the followings:

-

Market Research

Market research allows you to create a constructive implementation plan, from understanding your audience and identifying your project goals to considering the validity of your mobile app idea. It further helps you understand if you have realistic ROI goals and create a value proposition.

-

Competitor Analysis

The more you analyze your competitor, the better you understand the Dos and Don’ts of your business. It can help you define your ROI goals, USPs, etc.

-

Cost Analysis

A mobile banking app development company can help you plan your project budget smartly and engage in cost-efficient development.

-

Technology Stack

Once you finalize which platforms you want your app to run on, you can then identify the development technologies.

Suppose you are choosing to create native applications that run on dedicated platforms, i.e., iOS and Android, independently. In that case, you must include Swift for iPhone App Development and choose Kotlin with experienced Android App Developers.

If you want to create a cross-platform app using a single codebase, you can use frameworks like React Native, Flutter, etc.

-

Prototyping

By prototyping your mobile banking app, you can visualize the final product more effectively. Mobile banking application development companies can use their expertise to create interactive prototypes showcasing primary and advanced features.

-

Development

Now that we have a technology stack, a prototype, and a team, we can start by creating an interactive UI.

Furthermore, we can code the required features and functionalities to create a fully-fledged mobile banking app that brings results in terms of user engagement and customer experience.

-

Testing

You would want your mobile banking application development to enrich the customer experience from usability to functionality. You can achieve the performance goals with the help of an independent testing team.

-

Launch and Deployment

Once your mobile banking app has been tested, you can deliver, deploy, and launch.

Once developed and delivered, smooth deployment should be a priority for mobile app developers.

-

Maintenance

To sustain effectively, you need to maintain your mobile app consistently. High-quality real-time app performance can augment your product’s credibility in the market.

Top Mobile Banking App Examples to Consider For Development

Some leading banks worldwide have utilized mobile banking development to stay closer to their customers and sustain the technological competitiveness in the market.

Taking inspiration from an existing app can help create the roadmap for developing your mobile banking app.

-

Citibank

Citibank is a consumer-based financial services company. The company is headquartered in New York, United States. The company has designed its mobile banking app to focus on the needs of individual customer accounts with extensive virtual access.

-

Bank of America

It is a Charlotte-headquartered investment bank, affecting about 11% of complete bank deposits in the United States.

The bank has its mobile banking app available on both Play Store and App Store.

-

JPMorgan Chase

Among the largest banks in the world, JPMorgan Chase & Co. has a global predominance in the global banking space.

Over 62 million households are connected with JPMorgan Chase. The bank has one of the largest banking customer bases in the world.

-

HSBC Bank

It is a well-known banking, investment, and financial services company based in London, United Kingdom. The company offers commercial, investment, and personal banking services to its clients including enterprises and individuals.

The HSBC mobile banking app allows customers to manage accounts securely using their mobile devices. The application is available for personal Internet banking purposes. The bank also provides an HSBC business banking app for business-oriented banking.

How Much Does It Cost to Build a Mobile Banking App?

The banking app development cost may depend upon several factors. From personalizing features to customization, including diverse features in your mobile app can significantly affect the financial estimation. FinTech App Development Cost must be calculated based on the below factors.

-

Feature-wise

| Feature | Cost |

| Account creation portal | $5,000-$10,000 |

| Account management portal | $10,000-$15,000 |

| Payment integration | $7,000-$20,000 |

| Report generation | $10,000-$20,000 |

| Automated email generator | $8,000-$12,000 |

| Push notifications | ~$5,000 |

| Chatbot | $2,000-$8,000 |

-

Stage-wise

| Process | Cost |

| Discovery | ~$5,000 |

| App Design | $5,000 to $10,000 |

| Development | $35,000 to $100,000 |

| Testing | $10,000 to $30,000 |

| Deployment | $10,000 to $50,000 |

| Support & Maintenance | $5,000 to $10,000 |

How Can We Help You?

We, at SparxIT, have been working on mobile app design and development projects for more than 15 years. We have handled projects from diverse industry domains and complexity levels.

If you have an app idea and want to validate it before you develop it, hire a mobile banking app development company.

Conclusion

The mobile banking sector has grown dramatically in recent years. The technologically advanced mobile banking sector will be worth $1359.5 million by the end of 2028, says GlobeNewsWire.

If you are planning to create a mobile banking app, the best time to build one is today.

This blog post has helped you understand what creating a mobile banking app means, the development process, the cost, and what it takes to make a Flutter banking app.