For decades, insurance companies relied on actuarial tables, historical data, and gut feelings to assess customer risks. However, this “one-size-fits-all” approach led to inefficiencies like mistakes in the underwriting process or inaccurate risk assessment. According to reports, insurance fraud costs around $308.6 billion annually in the USA, a staggering figure that underscores the need for smarter, data-driven strategies.

This is where predictive analytics is reshaping the future of insurance. Predictive analytics can turn raw data into actionable insights. Apart from that, it leverages AI, machine learning, and big data from IoT devices to forecast risks and curb fraud losses by up to 60%.

Beyond fraud prevention, predictive analytics in insurance enables hyper-personalized policy offerings, more precise underwriting, and streamlined claims management. This aids in improving the overall customer experience by providing more tailored services.

Whether you’re an industry veteran or tech enthusiast, this blog will unpack how predictive analytics in insurance is redefining the rules.

What is Predictive Analytics in Insurance?

Today, insurance companies are inundated with vast data, ranging from customer and policy information to behavioral, geospatial, telematics, machine-generated, and health-specific data. These insurance datasets are often siloed across systems, making it difficult to extract meaningful insights. Predictive analytics addresses this challenge by analyzing large data sources to uncover patterns,

While the use of predictive analytics in insurance is not a new concept, insurers have relied on it for decades. The only change that occurs is the technology. The advent of AI and ML technologies has automated the mundane manual work, streamlining the process with efficiency. However, human oversight remains essential. Hence, big data analytics services will aid you in guiding the system, testing its output, and refining its decisions.

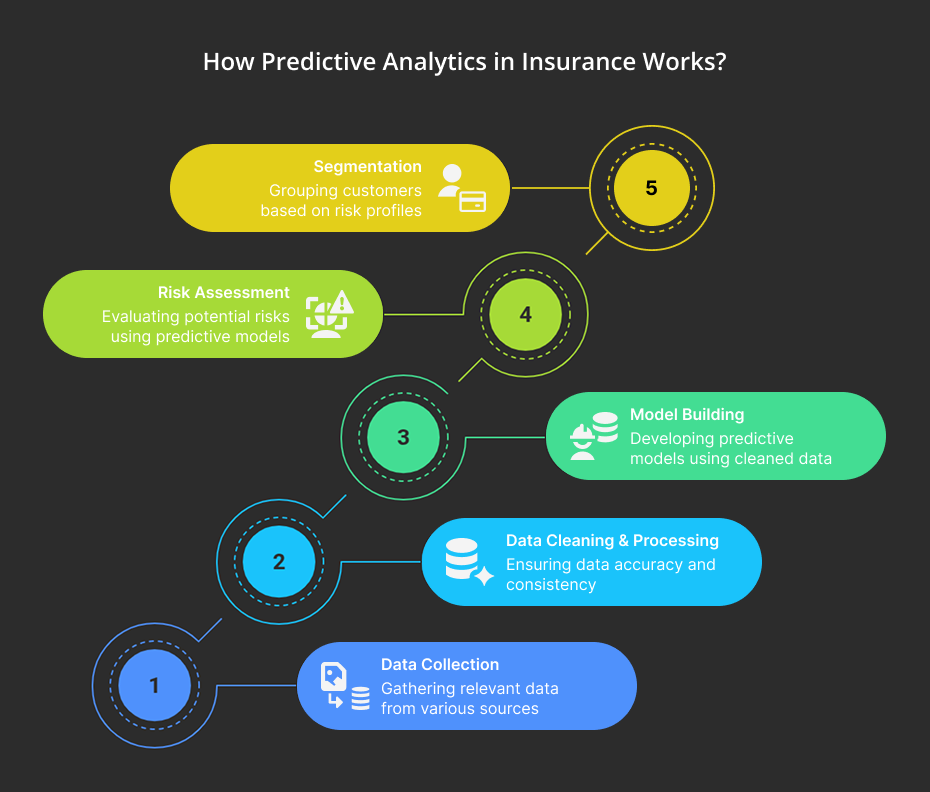

How Predictive Analytics in Insurance Works?

Predictive analytics for insurance utilizes statistical techniques and machine learning models to assess and analyze customer data, thereby predicting future risks. It enables insurers to improve the underwriting process, costs, claim management, and fraud detection, ultimately boosting efficiency and profitability.

Let’s explore how predictive analytics in the insurance industry works:

1. Data Collection

Insurers collect data for analysis from various sources, like:

- Customer demographics

- Driving records

- Medical history (for health insurance)

- Credit scores

- Claims history

This collected data is valuable in data analytics for insurance.

2. Data Cleaning and Processing

Once the data is collected, insurance companies often collaborate with data analytics service providers to clean, standardize, and transform data for accuracy and compatibility between insurance and data analytics.

3. Model Building

After that, predictive models are developed using ML algorithms. These models are based on historical data patterns that identify correlations and forecast future outcomes such as claim likelihood, claim severity, and customer churn.

4. Risk Assessment

The insurance data model analyzes individual customer data. These models examine customer risk profiles, which enables insurance companies to determine price premiums more accurately. Moreover, companies can make informed underwriting decisions.

5. Segmentation

Lastly, risk analytics in insurance helps insurers segment customers into groups. Through predictive modeling, organizations can segregate similar risk characteristics and then provide targeted marketing campaigns and product offerings.

Key Models for Predictive Analytics in Insurance

Different model types suit specific and different project needs, highlighting the importance of selecting the right approach. Consequently, Data intelligence services use diverse data science models in predictive analytics. Let’s understand them:

| Model Type | Key Features | Best For |

| Statistical Models (e.g., linear/logistic regression, survival analysis, time-series) |

|

|

| Non-Neural Network Machine Learning Models (e.g., XGBoost, Random Forest, SVM) |

|

|

| Deep Neural Networks (e.g., CNNs, RNNs, Transformers) |

|

|

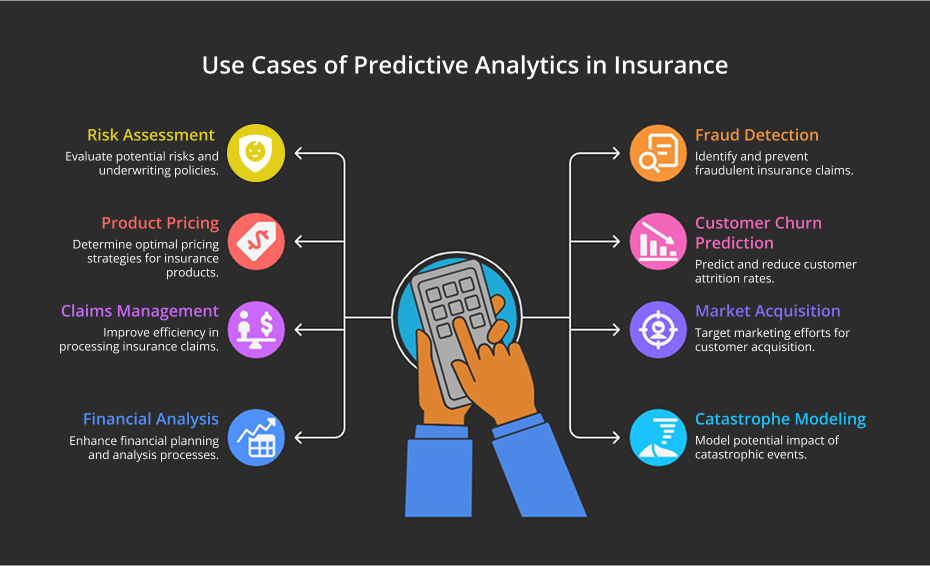

Predictive Analytics Use Cases in Insurance

The use of predictive analytics in insurance is reshaping how companies assess risk, detect fraud, and engage with customers. By analyzing massive datasets, insurers can make faster and smarter decisions across their operations. Let’s check the use cases of predictive analytics in the insurance industry.

-

Risk Assessment and Underwriting

Predictive analytics enables data-driven underwriting by:

- Analyzing historical claims, demographics, and IoT data

- Evaluating individual risk profiles more accurately

- Customizing premiums based on customer behavior

- Speeding up underwriting decisions by reducing manual workload

This way, technology adoption has significantly improved the speed to quote and improved risk handling capacity for complex cases.

-

Insurance Fraud Detection and Prevention

Fraudulent claims cost billions annually, and predictive analytics in the insurance industry is pivotal in minimizing the loss. These work like:

- AI models detect anomalies in claims behavior (e.g., inflated values, duplicate submissions)

- Real-time flagging of suspicious activity

- Enables faster claim approvals for genuine cases

-

Insurance Product Pricing

Customer analytics in insurance helps set up dynamic pricing models and balance risk profiles. Moreover, it offers market trends and competitor benchmarks to set competitive premiums. With predictive analytics, insurers can provide affordable insurance products without compromising profitability.

-

Customer Churn Prediction

Behavioral analytics in insurance aids significantly in predicting churn risk, allowing insurers to:

- Identify disengaged customers (e.g., late payments, low app usage)

- Launch retention strategies such as tailored offers or proactive support

The insurance industry sees high churn risks, 18% due to negative experiences.

-

Predictive Analytics for Claims Management

Another use of predictive analytics in insurance is claim management. Prompt claim resolution is one of the four factors contributing to a satisfying claim experience. AI can predict claim validity, complexity, and costs, accelerating approvals, reducing backlogs, and ensuring consistent settlement outcomes.

-

Dynamic Marketing and Customer Acquisition

Data analytics in insurance aids significantly by targeting high-value prospects with hyper-personalized campaigns. It further aids in optimizing ad budgets and improving lead conversions. According to the KPMG report, customer engagement is now a top KPI in insurance performance metrics.

-

Financial Planning and Analysis

Scenario-based insurance predictive modeling helps in financial planning. It projects revenue, claims costs, and market shifts, which assists in capital allocation, reinsurance planning, and regulatory compliance.

-

Catastrophe Modeling

Predictive data analytics in insurance helps with geospatial and climate simulations to predict disaster-related losses. It enables proactive reinsurance purchases, reserve adjustments, and mitigation to safeguard solvency.

Significant Benefits of Predictive Analytics in Insurance

The advent of technology, like AI, ML, and big data analytics in insurance, offers significant benefits to businesses and customers alike. Here are some of the key advantages that this future-specific technology brings to the insurance industry:

Savings on expenses

Insurance analytics solutions help insurers obtain valuable insights that they can utilize to improve decision-making, close gaps, and streamline operations. These all help insurance companies reduce their operating expenses.

Finding Possible Markets

Insurers may find and target prospective areas with significant revenue opportunities with the use of big data in insurance predictive analytics. By using demographic data, insurers can target their sales and marketing efforts.

Offering a Tailored Experience

By leveraging insurance claim data analytics, insurers can quickly unify data from multiple sources to gain a holistic view of their customers. This deeper understanding of risk profiles and buying behaviors supports stronger relationships and enables “personalization at scale,” through predictive analytics.

Optimal Use of Resources

Insurance data analytics solutions facilitate the allocation of resources to higher-priority activities, ensuring the seamless operation of the organization. They also increase overall productivity by enhancing resource availability, uptime, and proactive risk management.

Present New Customized Products and Services

Advanced analytics in insurance allow insurers to foresee future needs. By applying these insights to refine the specifications of current products and services, insurers can improve client satisfaction and profitability. As a result of these findings, insurers may be able to diversify their products.

Step-by-Step Process to Implement Predictive Analytics in Insurance

We’ve covered why predictive analytics is a game-changer for insurance, its use cases, and the benefits. Now, let’s get down to the process. It’s a structured approach that will help create neoteric insurance analytics solutions.

1. Define Business Objectives

The more precise and clear you are, the better insurance data analytics solutions you will develop. Hence, document clearly what you want to achieve with your solutions, covering:

-

Set clear goals

What goals can be achieved by implementing predictive analytics in insurance? It might include fraud detection, risk assessment, underwriting accuracy, pricing optimization, or improving customer satisfaction. Document them clearly.

-

Identify Areas for Improvement

Find the areas of insurance operations that could benefit from the insurance analytics solution you are preparing. These could include risk assessment, customer retention, claims management, or other relevant functions.

2. Select a Predictive Analytics Partner

The next step is to collaborate with an experienced predictive analytics service provider with hands-on experience in the insurance industry. Evaluate different service providers based on:

- Their portfolio (specific to your project’s needs)

- Deep industry knowledge

- Proven expertise in risk modeling

- Track record of success in machine learning development

An agency should offer tailored solutions, robust data security, and ongoing support.

3. Data Collection and Preparation

This is the backbone stage where relevant data is gathered, cleaned, and structured for analysis, ensuring quality for precise predictions.

-

Gather Data Sources

To build an insurance analytics solution, data gathering is crucial and is the first step towards building the foundation. For this, a collection of internal and external data is performed, relevant to your objectives.

| Internal Data | External Data |

| Policyholder’s details | Demographics |

| Claim history | Weather patterns |

| Underwriting data | Credit scores |

-

Data cleansing and integration

After that, the data is cleansed for inconsistencies, missing values, and format issues. Then, data from various sources is integrated into a unified dataset.

-

Feature engineering

Once data cleansing and integration are completed, develop new features or enhance existing ones to boost the performance of the insurance data model.

4. Model Development and Selection

In this stage, various models are built and tested, and the one that best predicts the desired outcome is picked, such as risk assessment.

-

Choose Appropriate Algorithms

Now, select machine learning algorithms based on the nature of your data and business objectives, such as decision trees, neural networks, or regression models.

-

Model Training

Train predictive models and use historical data to identify patterns and relationships between variables.

-

Model Evaluation

Assess model performance using metrics like accuracy, precision, recall, and AUC to ensure reliability.

5. Model Deployment and Integration

Embed the chosen model into existing systems, making predictions accessible for daily decision-making.

-

Operational Integration

Incorporate predictive modeling into insurance systems and workflows, such as underwriting platforms or claims processing tools.

-

User Interface Development

Create user-friendly interfaces for stakeholders to access and interpret model outputs.

6. Monitoring and Refinement

Continuously track model performance, adjust parameters to maintain accuracy, and adapt to changing conditions.

-

Continuous monitoring

Regularly monitor model performance in real-world scenarios to detect data drift and potential issues.

-

Model retraining

As needed, update models with new data to maintain accuracy and relevance over time.

Key Technologies Powering Predictive Analytics in Insurance

Predicting the likelihood of events in insurance is not powered by a single tool or platform, but rather by an ecosystem of technologies working in harmony. These core technologies enable insurers to extract insights from complex data, automate decisions, and stay ahead of risk. Below are the key pillars:

1. Big Data Infrastructure

Insurance companies deal with vast volumes of data, including policies, claims, customer interactions, and third-party sources like telematics. Big data infrastructure enables storage, processing, and real-time access to this information.

- Technologies: Apache Hadoop, Apache Spark, Snowflake, AWS S3, Azure Data Lake

- Use Case Example: Aggregating claim histories to predict fraudulent behavior.

2. Machine Learning & AI Frameworks

These frameworks help develop and deploy algorithms that learn patterns and predict future outcomes, such as claim probabilities, customer churn, or underwriting risk. Thus, setting the stage for predictive analytics in insurance.

- Technologies: TensorFlow, PyTorch, Scikit-learn, H2O.ai

- Use Case Example: Predicting claim likelihood based on customer demographics and historical data

3. Data Integration & ETL (Extract, Transform, Load)

Insurance data is siloed across various platforms, like CRM, ERP, and claims systems. Integration tools ensure this data is unified and prepared for modeling.

- Technologies: Apache Kafka, Talend, MuleSoft

- Use Case Example: Pulling real-time data from telematics for dynamic policy pricing.

4. Cloud Computing

Cloud platforms offer the flexibility, scalability, and computing power required to run predictive analytics models on massive datasets.

- Technologies: AWS (with SageMaker), Google Cloud (with Vertex AI), Microsoft Azure (with ML Studio)

- Use Case Example: Running policy risk simulations in parallel across cloud instances.

5. Visualization & Business Intelligence

Predictive insights must be easily interpretable by underwriters, actuaries, and executives. Business analytics in insurance, powered by BI tools, transforms raw data into clear visualizations.

- Technologies: Tableau, Power BI, Looker

- Use Case Example: Dashboards showing churn-risk segments and associated revenue loss predictions.

6. Fraud Detection & Risk Analytics Engines

Insurance fraud is a high-cost risk. Specialized fraud detection engines help spot anomalies in real time using predictive scoring.

- Technologies: IBM Safer Payments, SAS Fraud Management, Palantir Foundry

- Use Case Example: Real-time alerting when claim behavior deviates from expected norms.

7. Data Security & Compliance Tools

Insurance firms handle sensitive data that must comply with regulations like GDPR, HIPAA, and local insurance acts. Security tools ensure protected and ethical use of data in analytics.

- Technologies: IBM Guardium, AWS Security Hub, GDPR compliance frameworks

- Use Case Example: Audit trails for AI-based underwriting decisions.

Challenges in Implementing Predictive Analytics for Insurance & Proven Solutions

Insurers face hurdles like legacy systems, fragmented data, compliance demands, and skill gaps, which delay predictive analytics adoption and ethical AI integration and inflate costs and risks.

1. Legacy System Dependency

Age-old systems struggle to keep up the pace with up-to-date tools and analytics. As a result, they often rely on costly middleware or face slow modernization, which delays real-time data processing and innovation.

2. Data Quality Issues

Inconsistent formats, missing entries, and duplicate records corrupt model accuracy. To ensure reliable predictive outcomes, rigorous cleansing and governance frameworks are required.

3. Data Privacy and Security

Implementing AI-powered fraud detection in insurance requires strict GDPR/CCPA compliance, encrypted storage, access controls, and anonymization. Leveraging data analytics in insurance while balancing utility with breach risks that threaten trust and regulatory penalties can sometimes be challenging.

4. Data Integration Complexity

Merging siloed claims, IoT, and CRM datasets demands scalable APIs and ETL pipelines. Additionally, they exceed traditional insurers’ budgets and technical capabilities.

5. Model Biasness

Historical data reflecting past inequities skew risk scoring. Audits and synthetic data diversification are critical to ensuring fairness in underwriting and pricing.

6. Lack of Expertise

Limited in-house data scientists and AI engineers can delay deployment. Hence, partnerships with data science consulting companies or upskilling programs are necessary to bridge talent gaps.

7. Resistance to Change

Skepticism among underwriters and agents towards the predictive analytics use case requires cultural shifts, training, and phased rollouts to demonstrate value and reduce friction.

Potential Solutions for Integrating Predictive Analytics Easily

While the insurance industry grapples with significant challenges, its innovative solutions are poised to overcome them. Here are some potential insurance analytics solutions:

-

Data Governance Practices

Implement standardized metadata frameworks, automated cleansing workflows, and role-based access to eliminate silos. Additionally, ensure compliance and maintain data accuracy in insurance software development.

-

Modern Data Security Measures

Deploy zero-trust architecture, quantum-resistant encryption, and AI-driven anomaly detection to protect sensitive data. Moreover, use predictive analytics in insurance underwriting while adhering to GDPR, HIPAA, and evolving regulatory standards.

-

Use Robust Data Integration Tools

Adopt scalable platforms (e.g., Apache NiFi, Talend) with pre-built connectors for legacy systems. You can also add real-time ETL pipelines to unify structured/unstructured data sources.

-

Collaborate with Data Scientists

Partner with a digital transformation services provider or analytics firm to develop interpretable models. Remember to keep alignment with actuarial principles and business KPIs.

-

Regularly Monitor and Validate Model

Leverage MLOps services for bias audits, performance drift detection, and recalibration using fresh data to sustain accuracy and fairness.

-

Provide Training and Education

Upskill employees via workshops on AI ethics, tools like Python/R, and change-management strategies to foster data-driven decision-making.

Real-World Examples of Predictive Analytics in Insurance

Predictive analytics reshapes insurance through health wearables, telematics-driven auto policies, climate-risk property models, and AI-powered life underwriting. It can mitigate risks while enhancing customer satisfaction and operational efficiency. Let’s look at some insurance predictive analytics examples.

1. Predictive Analytics in Health Insurance

The advent of modern tools and technologies, like predictive analytics in health insurance, has transformed the entire industry by making the most of patient data to forecast chronic disease risks and hospitalization rates. Let’s check how predictive analytics is changing the entire insurance industry.

-

Personalized Premiums Based on Health Data

Insurers analyze wearable device data (e.g., Fitbit) and EHRs to adjust premiums using activity levels, sleep patterns, and genetic predispositions. This helps promote healthier lifestyles and reduces adverse selection.

-

Predictive Models for Chronic Disease Management

AI identifies high-risk patients via EHR trends and lifestyle data. AI in insurance offers early interventions (e.g., diet plans) to curb the progression. It cuts hospitalization costs by 15–20% in value-based care models.

2. Predictive Analytics in Auto Insurance

Predictive analytics helps auto insurance companies analyze driving behavior, vehicle telematics, and accident patterns. Additionally, predictive modeling in insurance optimizes auto insurance premiums and streamlines claims processing while mitigating fraud risks through real-time data insights.

-

Usage-Based Insurance (UBI) with Telematics

Telematics devices track driving behavior (e.g., braking, mileage), which allows insurers to offer dynamic premiums, with safe drivers saving up to 30% annually.

- Accident Probability Forecasting

Machine learning in insurance analyzes historical collision data, weather forecasts, and traffic patterns to predict high-risk zones.

3. Predictive Analytics in Life Insurance

Life insurers leverage predictive analytics to assess mortality risks, refine underwriting with health/lifestyle data, and offer dynamic pricing. Let’s see how predictive analytics in life insurance is reshaping the industry

-

Longevity Predictions Using Health Metrics

AI models process wearable data like heart rate variability and lab results to estimate lifespan, refining term lengths and pricing for insurers like John Hancock.

-

Automated Underwriting Processes

Ladder Life employs NLP in insurance to parse medical records and social data. They deliver instant approvals with 95% accuracy, slashing processing times from weeks to minutes.

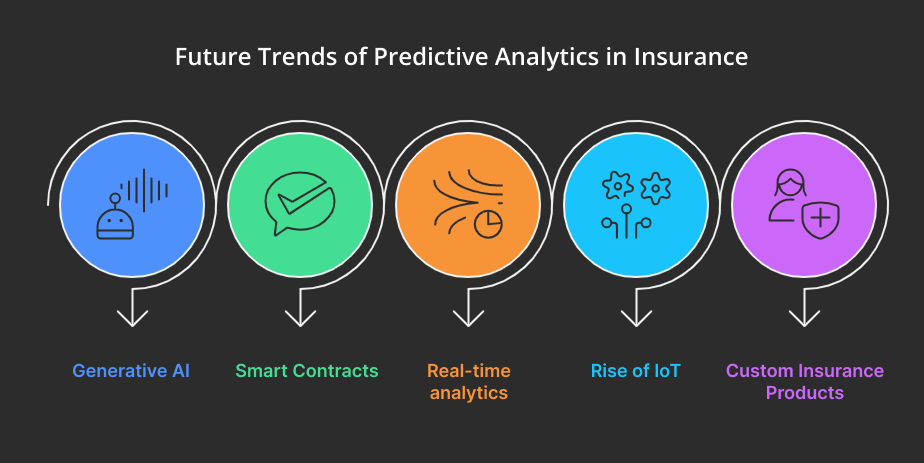

Future Trends in Predictive Analytics for Insurance

Future insurance analytics will leverage AI, blockchain, and IoT for real-time risk insights, hyper-personalized products, and automated claims to boost efficiency, fraud resilience, and customer-centric innovation. Let’s look at the emerging trends that will shape the future of insurance.

1. AI and Machine Learning Advancements

From claims automation to predictive risk modeling, let’s see how AI and machine learning will reshape insurance workflows to drive efficiency and enhance customer experience.

- Advanced gen AI models will simulate rare catastrophes like cyberattacks and pandemics to stress-test portfolios and plan reinsurance

- Neural networks will analyze complex and unstructured data to predict emerging risks.

- AI and ML advancements in predictive analytics for insurance would bring computer vision into the process to automate claim assessment.

- Conversational AI will help elevate customer service. And GPT-4 is one example of predictive analytics in the insurance industry, enabling timely responses

2. Blockchain and Smart Contracts

In the future, the shift will be toward decentralized insurance ecosystems, where AI-augmented smart contracts autonomously adjust coverage terms and payouts based on real-world triggers (e.g., climate events), reducing disputes.

- Smart contracts use real-time IoT data to trigger instant, paperless insurance payouts and reduce disputes.

- Blockchain ensures secure, tamper-proof claims and policy records, reducing fraud and enabling regulatory compliance.

- Federated learning and blockchain-backed data promote fair, bias-free AI decisions in underwriting and claims.

3. Real-Time Analytics and Decision-Making

The future hinges on edge computing and 5G, which enable microsecond-level risk assessments. Through hyper-responsive analytics, insurers might preemptively mitigate claims (e.g., alert drivers of hazards).

- Edge computing apps in insurance connect devices like smart cars to enable real-time driver risk scoring and instant premium updates without cloud dependency.

- IoT sensors monitor ongoing risks to proactively adjust coverage terms and prevent losses.

4. Rise of IoT & Telematics in Insurance

With IoT 2.0, analyze predictive maintenance ecosystems (e.g., connected homes/cars that flag risks pre-failure) and ethical debates around data ownership in a hyper-surveilled insurance landscape.

- Drones and satellite imagery enable automated crop damage assessments and claims processing in agriculture insurance through satellite and geospatial data applications.

- Leak detectors reduce water damage claims and premiums by alerting insurers early, powered by predictive analytics in insurance industry.

5. Hyper-Personalized Insurance Products

The future of predictive or risk analytics in insurance looks promising, with “living policies” that evolve with customers’ lifestyles. Insurance companies can use genomic data, mental health trends, or gig-economy shifts to address fairness in pricing and algorithmic bias in ultra-niche segmentation.

- Usage-based predictive analytics in insurance powers app-activated micro-policies for short-term rentals and gig work.

- NLP bots are helpful in personalizing insurance offers through chat and spending data, increasing digital conversion rates by 30%.

Build Future-Ready Predictive Analytics Solutions for Insurance With SparxIT

Staying ahead in insurance demands intelligent risk insights, fraud resilience, and customer-centricity. At SparxIT, we build custom predictive analytics solutions that transform raw data into actionable strategies. We empower insurers across the USA, UK, UAE, and globally to achieve tangible results.

Our AI-powered models analyze IoT feeds, claims history, and customer behavior to optimize underwriting accuracy, slash fraudulent payouts, and personalize policy pricing.

With digital consulting, we tackle legacy system bottlenecks with seamless API integrations, unify siloed data lakes, and deploy blockchain for transparent, secure workflows. From real-time catastrophe modeling to AI-driven claims automation, our tools boost customer retention through dynamic, usage-based policies.

With expertise in insurance fraud detection software development and cybersecurity, we future-proof your operations against emerging risks like cyber threats or climate volatility. Partner with SparxIT to implement predictive analytics in insurance to scale rapidly.

Partner with Experts

Frequently Asked Questions

What is predictive modeling in insurance?

Predictive modeling in insurance uses data analytics, statistical algorithms, and machine learning to forecast future outcomes such as claim likelihood, policy lapse, fraud detection, or customer lifetime value. It helps insurers make more informed, data-driven decisions.

How is AI used in predictive analytics for insurance?

AI analyzes claims history, telematics, and customer behavior to forecast risks, flag fraud, and personalize pricing, cutting costs and boosting accuracy in underwriting and claims.

How Much Does it Cost to Implement Predictive Analytics in Insurance?

The cost of implementing predictive analytics in insurance ranges from $50,000 to $300,000+, depending on data complexity, AI models, cloud infrastructure, integration, compliance, and ongoing maintenance. Expert collaboration ensures cost-effective, scalable solutions.

What data sources are used in predictive analytics for insurers?

Insurers use IoT devices, wearables, historical claims, credit scores, social media, and geospatial data to model risks and tailor policies dynamically.

What are the biggest challenges of implementing predictive analytics in insurance?

Legacy tech, siloed data, privacy laws, and talent gaps slow adoption, while biased models risk unfair pricing or claim denials

What are the key benefits of predictive analytics for insurance companies?

Sharper risk pricing, fraud prevention, faster claims, and hyper-personalized policies drive profit margins up and customer churn down by 20–30%.

What tools or technologies are commonly used for predictive analytics in insurance?

Predictive analytics in insurance uses tools and technologies like TensorFlow, Scikit-learn, Tableau, Power BI, and big data platforms like Hadoop and Spark. Cloud services (AWS, Azure), AI/NLP models (e.g., GPT), and IoT/telematics devices also play a key role in forecasting risks and personalizing policies.

How is predictive analytics in insurance used to detect and prevent fraud?

The use of predictive analytics in insurance aids in identifying and preventing fraud by leveraging advanced techniques such as machine learning and data analysis. This is done by analyzing claims data, underwriting patterns, and detecting suspicious user behavior.

How can predictive analytics in insurance improve claims management efficiency?

Claims management efficiency is improved by predictive analytics by automating tasks, identifying potential fraud, and optimizing resources accordingly. By analyzing historical patterns, predictive modeling in insurance aids in anticipating claims, reducing processing time, and improving overall user satisfaction.