The insurance industry is under constant pressure to process claims faster, reduce operational costs, and deliver seamless customer experiences. Yet many insurers still rely on manual workflows, siloed systems, and legacy platforms that slow down operations and increase error rates. As policy volumes grow and customer expectations rise, these inefficiencies become harder to ignore.

This is where automation in insurance industry is redefining how insurers operate. By leveraging technologies such as robotic process automation, artificial intelligence services, and intelligent workflows, insurers can streamline core operations, improve accuracy, and scale without adding complexity. From claims processing to underwriting and compliance, automation is a present-day necessity.

In this guide, we will explore how automation is transforming the insurance industry, the technologies driving this change, real-world use cases, business benefits, and what the future holds for decision-makers who embrace intelligent process automation in insurance.

What is Automation in Insurance?

Automation in the insurance sector refers to the use of digital technologies to reduce or eliminate manual intervention across insurance operations. This includes automating repetitive and rule-based tasks as well as more complex, decision-driven processes using cognitive intelligence.

At its core, insurance automation solutions aim to standardize workflows, minimize human error, and improve processing speed across the policy lifecycle. From customer onboarding and policy issuance to claims settlement and reporting, automation helps insurers handle high volumes of work with greater efficiency and consistency.

In fact, insurance process automation enables insurers to orchestrate workflows across departments and systems. Instead of fragmented handoffs between teams, automated processes ensure tasks move seamlessly from one stage to another, improving turnaround times and service quality.

Evolution of Automation in Insurance Industry

The journey of automation in insurance has evolved significantly over the past two decades.

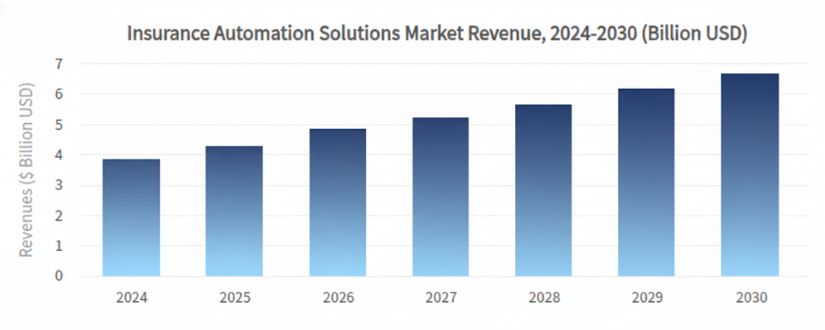

In fact, the global insurance automation solutions market was worth $4.3 billion in 2024. It is expected to grow to $4.6 billion in 2025 and reach USD 6.9 billion by 2030, expanding at a compound annual growth rate of 8.2%.

What began as basic digitization has now matured into intelligent systems capable of handling complex insurance operations. Let’s look at the evolution.

-

Insurance Business Process Automation

Early automation initiatives focused on business process automation in insurance, digitizing repetitive administrative tasks such as data entry, policy updates, and document handling. These efforts helped insurers reduce paperwork and improve internal efficiency, but were still limited in scope.

During this phase, insurers adopted IT process automation to standardize workflows and reduce dependency on manual labor. While effective for simple tasks, these systems lacked flexibility and struggled with unstructured data and exceptions.

-

From Rule-Based Automation to Intelligent Systems

As insurance operations grew more complex, rule-based automation alone was no longer sufficient. The shift toward AI automation in insurance marked a turning point. Technologies such as machine learning, natural language processing, and computer vision enabled automation to handle unstructured data and make context-aware decisions.

The integration of AI allowed insurers to move beyond static rules and toward adaptive, learning-based systems. This evolution laid the foundation for intelligent process automation in insurance, where systems continuously improve based on data and outcomes.

-

Cognitive Automation in Insurance

The most advanced stage in this evolution is cognitive automation. These systems mimic human decision-making by understanding language, recognizing patterns, and interpreting documents such as claim forms, medical reports, and policy contracts.

These capabilities enable insurers to automate complex tasks like fraud detection, risk assessment, and claims adjudication with greater accuracy and speed. Cognitive automation in insurance also plays a key role in enhancing customer interactions by integrating AI chatbots and virtual assistants.

Why Intelligent Automation in Insurance Is Necessary

Insurance operations today are far more complex than they were a decade ago. Insurers must manage high transaction volumes, comply with evolving regulations, and meet rising customer expectations for speed and transparency. Traditional automation alone cannot keep up with this level of complexity.

- The growing adoption of AI in Insurance has made intelligent automation a necessity rather than an option. Unlike basic automation, insurance process automation combines AI, data analytics, and automation technologies to handle judgment-based tasks such as risk evaluation, fraud detection, and exception handling.

- Another key driver is the burden of outdated systems. Many insurers operate on legacy platforms that restrict agility and innovation. Automation in insurance often begins with legacy application modernization, enabling insurers to remove system bottlenecks and support advanced automation capabilities without disrupting core operations.

- Ultimately, intelligent automation in insurance helps insurers shift from reactive operations to proactive, data-driven decision-making while improving resilience and scalability.

What is Robotic Process Automation in Insurance?

Robotic process automation (RPA) is one of the most widely adopted automation technologies in the insurance sector. It uses software bots to mimic human actions across digital systems, executing repetitive and rule-based tasks with speed and accuracy.

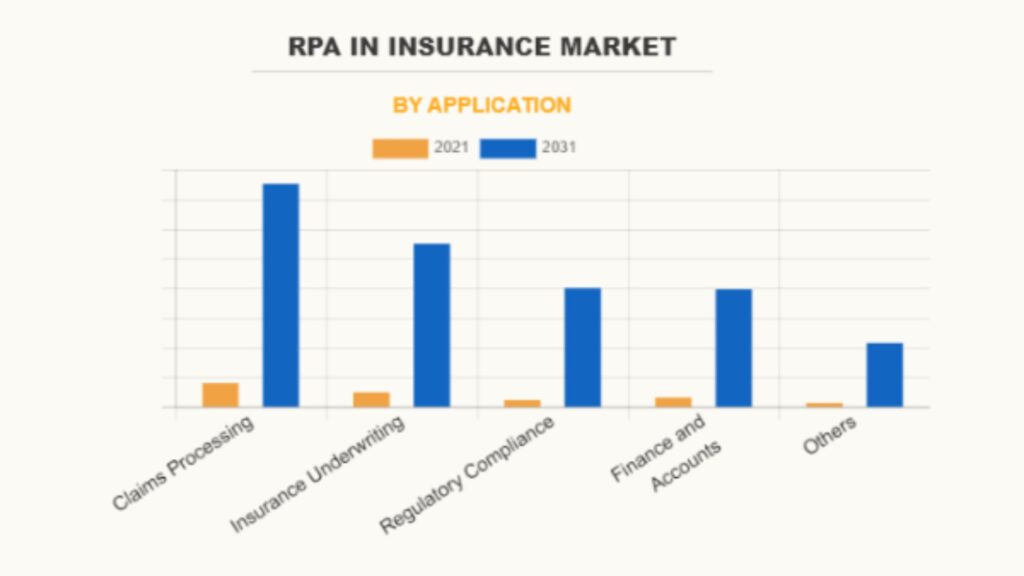

According to a report by Allied Market Research, the RPA in insurance market was valued at $98.56 million in 2021 and is expected to grow to $1.2 billion by 2031, registering a strong CAGR of 28.3% over the forecast period.

Insurance robotic process automation is commonly used to automate activities such as data extraction, form validation, policy updates, and claims routing. These bots interact with existing applications at the user interface level, allowing insurers to automate processes without changing underlying systems.

RPA serves as a foundational layer that enables insurers to automate high-volume tasks quickly while preparing their operations for more advanced forms of automation.

How Insurance Robotic Process Automation Works?

RPA works by configuring software bots to follow predefined rules and workflows. These bots log into applications, extract data, validate information, and trigger downstream actions just like a human user would.

In practice, robotic process automation in Insurance integrates with core systems such as policy administration platforms, claims management systems, and customer databases. Bots can operate around the clock, ensuring uninterrupted processing and faster turnaround times.

When combined with analytics and AI, RPA can also handle semi-structured tasks, making it a key enabler of scalable insurance operations.

Robotic Process Automation Use Cases in Insurance

The adoption of RPA spans multiple insurance functions. Some of the most common use cases of RPA in insurance include–

- Automating claims intake

- Updating policy records

- Processing renewals

- Reconciling payments

- Generating compliance reports

By automating these workflows, insurers reduce manual effort, minimize errors, and improve consistency across operations. RPA also frees up employees to focus on higher-value tasks such as customer engagement and decision-making.

-

End-to-End Insurance Claims Automation

Automation of insurance claims streamlines the entire claims lifecycle, from first notice of loss to settlement. Automated workflows ensure faster claims registration, validation, and approval while reducing human intervention. Studies show that automated claims systems can cut processing times by as much as 70% compared to manual workflows.

-

Document Automation for Insurance

Handling large volumes of paperwork is a persistent challenge for insurers. Document automation in insurance uses OCR and AI-driven extraction tools to digitize and process claim forms, invoices, and policy documents accurately and efficiently.

-

Fraud Detection Through Automation

Automation plays a critical role in identifying suspicious patterns and anomalies. The use of predictive analytics in insurance enables insurers to detect fraud early by analyzing historical data, behavioral patterns, and real-time signals.

-

Robotic Process Automation in Life Insurance

Life insurance operations involve complex underwriting and compliance requirements. Life insurance process automation helps automate medical data validation, policy issuance, premium processing, and claims verification, improving accuracy and turnaround time.

-

Insurance Policy Automation Solutions

Modern insurance policy automation enables automated policy creation, endorsements, renewals, and cancellations. These systems ensure consistency across policy documents while reducing processing delays and administrative overhead.

Insurance Process Automation Across Core Functions

Automation extends well beyond claims and policies. It offers complete enterprise application modernization for the insurance industry to manage internal and customer-facing operations.

-

Insurance Workflow Automation

This ensures tasks move seamlessly across departments, reducing delays and improving coordination between underwriting, claims, finance, and compliance teams.

-

Insurance Portal Automation for Customers and Agents

Customer and agent portals are critical touchpoints. Automation in these portals enhances self-service capabilities, especially when built by an experienced insurance app development company that understands security and usability requirements.

-

Insurance Report Automation and Analytics

With report automation, insurers can generate real-time operational and regulatory reports, improving visibility and decision-making across the organization.

-

End-to-End Insurance Payment Automation

Insurance payment automation simplifies premium collection, reconciliation, and claims payouts by eliminating manual payment handling.

-

Automating Premium Collection and Claims Payout

Insurance operations automation ensures timely premium reminders, accurate collections, and faster claims disbursement, improving cash flow and customer trust.

-

Insurance Marketing Automation

Marketing automation for insurance helps insurers personalize campaigns, nurture leads, and improve customer retention through automated engagement across digital channels.

-

Automation in Cloud Computing Insurance Platforms

Cloud-native environments support scalability and flexibility. Automating cloud insurance platforms enables insurers to deploy, manage, and scale automation solutions efficiently.

-

Insurance Compliance Automation

Regulatory compliance is a critical concern. It ensures consistent adherence to regulatory standards by maintaining audit trails, automating reporting, and reducing compliance risks.

Benefits of Automation in Insurance Industry

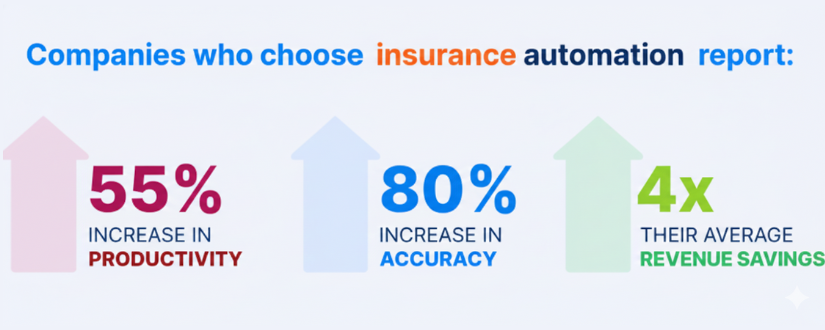

The advantages of automation in insurance industry extend far beyond basic operational efficiency. Insurance automation solutions enable insurers to create faster, more resilient, and customer-centric operations while delivering measurable business outcomes across the value chain. Let’s look at the benefits below-

-

Operational Efficiency

Automation in insurance industry significantly reduces manual workloads by streamlining repetitive and rule-based tasks across underwriting, claims, finance, and compliance teams. This allows employees to focus on higher-value activities such as customer engagement and strategic decision-making.

-

Cost Reduction

By minimizing human intervention and rework, automation lowers administrative overhead and operational costs. Insurers can handle higher transaction volumes without proportionally increasing staffing or infrastructure expenses.

-

Improved Customer Experience

Process automation in insurance industry enables faster response times, real-time updates, and self-service options through digital channels. These capabilities improve transparency, reduce customer frustration, and build long-term trust.

-

Faster Turnaround

Automated workflows shorten processing cycles for claims, policy issuance, renewals, and payments, enabling quicker resolutions and improved service delivery.

-

Accuracy, Compliance, and Scalability

Automated processes reduce errors, maintain audit trails, strengthen regulatory compliance, and support seamless scaling as business demand grows.

Tools and Tech Stack Used for Robotic Process Automation in Insurance

A robust technology stack is essential for successful automation. Modern insurance software development integrates RPA tools, AI models, workflow engines, and analytics platforms.

| Technology Layer | Tools Used |

| RPA Platforms | UiPath, Automation Anywhere, Blue Prism |

| AI & Machine Learning | Google Cloud AI, AWS AI Services, Microsoft Azure AI |

| Workflow Orchestration & BPM | Camunda, Pega |

| Integration & API Management | MuleSoft, Apache Kafka |

| Analytics & Reporting | Power BI, Tableau |

| Security & Compliance | Okta, Splunk |

| Cloud Infrastructure | AWS, Microsoft Azure, Google Cloud Platform |

Advanced automation initiatives often rely on AI integration services to connect machine learning models with core insurance systems. These integrations enable intelligent decision-making across workflows.

The Future of Automation in Insurance Industry

In this section, you’ll understand where automation in insurance is headed and how future-ready insurers are preparing for the next wave.

-

AI-Led Innovation and Autonomous Operations

The future of automation insurance will be shaped by AI-enabled innovation and deeper ecosystem integration. As insurers move beyond task-level automation, they will increasingly invest in AI transformation services to build autonomous and self-learning systems.

These systems will support predictive underwriting, dynamic pricing, and real-time risk assessment by continuously learning from historical and live data.

-

Hyperautomation and End-to-End Process Orchestration

Automation for insurance industry will evolve into hyperautomation, where multiple technologies such as RPA, AI, analytics, and workflow orchestration work together. This will enable end-to-end automation across claims, policy management, payments, and compliance, reducing human dependency while improving speed and accuracy.

-

Automation as a Core Digital Strategy

As automation matures, insurers will no longer treat it as an operational tool. Instead, it will become a core pillar of AI in digital transformation, supporting long-term competitiveness, business resilience, and the ability to adapt quickly to regulatory changes and evolving customer expectations.

How Can SparxIT Help You with Insurance Automation Solutions?

As one of the trusted insurance software development companies, SparxIT helps insurers plan, build, and scale automation initiatives that align with real business objectives. We work closely with insurance teams to identify automation-ready processes, eliminate operational bottlenecks, and improve turnaround times across claims, policy, and compliance workflows.

Being a reliable digital transformation services provider, we deliver end-to-end insurance automation solutions powered by RPA, AI-driven workflows, and modern system architectures. Our approach focuses on security, scalability, and seamless integration with existing platforms, ensuring that automation in insurance achieves measurable efficiency gains while staying compliant and future-ready.

Partner with Experts

Frequently Asked Questions

Which insurance processes can be automated?

Insurers can automate claims processing, underwriting, policy administration, payments, compliance reporting, customer onboarding, and marketing workflows.

Is automation suitable for life insurance companies?

Yes, automation is highly effective for life insurance, especially for underwriting, policy issuance, premium management, and claims processing.

How do insurers measure ROI from automation initiatives?

ROI is measured through cost savings, reduced processing time, error reduction, improved compliance, and enhanced customer satisfaction.

How long does it take to implement automation in insurance?

Implementation timelines typically range from a few weeks for RPA to several months for intelligent automation, depending on complexity.

Can insurance process automation be integrated with legacy systems?

Yes, automation solutions can integrate with legacy systems using bots, APIs, and middleware without replacing core platforms.

Are custom insurance automation solutions secure and compliant with regulations?

Yes, when designed correctly, custom automation solutions include security controls, audit trails, and compliance mechanisms aligned with regulatory standards.