Innovation in the financial sector has triggered major changes in the global economy. Companies across industries are experiencing fast-paced digital transformation as they respond to shifting consumer demands and competitive pressures. Within this transformation, technology has enabled the finance industry to evolve rapidly, offering smarter, more accessible, and efficient solutions.

Fintech is at the forefront of this evolution, experiencing rapid growth and attracting over $2 billion in investment last year. This surge reflects the sector’s ability to connect businesses and consumers through financial solutions that are not only more efficient but also more cost-effective. As the fintech space expands, its influence on both large corporations and everyday users becomes increasingly profound.

What Is FinTech App Development?

Fintech, short for financial technology, is all about leveraging digital innovation to automate and improve financial services. It enables individuals and businesses to manage payments, investments, and transactions with greater convenience and transparency. The increasing demand for tailored digital experiences has led to a rise in fintech app development, allowing companies to deliver powerful and user-centric financial tools.

In recent years, the fintech ecosystem has experienced significant growth. As of 2021, the United States had more than 10,600 fintech startups, making it the largest hub for fintech innovation globally.

Meanwhile, India has emerged as a key player in the fintech arena. With a current market valuation of $31 billion, the Indian fintech sector is projected to reach $84 billion by 2025, growing at a compound annual growth rate (CAGR) of 22%. This rapid expansion is driven by the widespread adoption of fintech applications that integrate technologies like AI, machine learning, data analytics, and automation.

Today, fintech companies rely on these advanced technologies to process large volumes of financial data, detect fraud, assess risk, and make intelligent, data-backed decisions. Collaborating with an experienced fintech app development company allows businesses to build fintech apps that not only meet modern expectations but also deliver secure, scalable, and high-performance solutions.

Is Fintech Changing the Way Tech Companies Do Business?

eCommerce players such as Flipkart have incorporated fintech business models to take advantage of the growing trend of cashless payments. For instance, consumers have the option of ‘buy now, pay later’. In addition to this, Flipkart offers mobile phone insurance under its Complete Mobile Protection program. Moreover, it has also built a digital wallet that is compatible with UPI. The payments market in India has been entered by global players like Google, WhatsApp, and Amazon.

Financial technology companies that are in the transaction delivery space create free products, such as expense management apps, in order to collect customer information and cross-pollinate it among the business to determine a customer’s likelihood of paying premiums, purchasing real estate, and investing in mutual funds.

Financial companies are utilizing technologies with the help of Blockchain or Artificial Intelligence, Machine Learning, etc., to assist businesses to manage their financial activities like accepting payments, paying bills, and other financial app development solutions as needed. In addition, they support consumers, business owners, and companies to understand investment risks and purchasing alternatives before making a buying decision.

Fintech applications are being adopted by many leading financial institutions and startups to optimize their financial operations and reduce operational expenses.

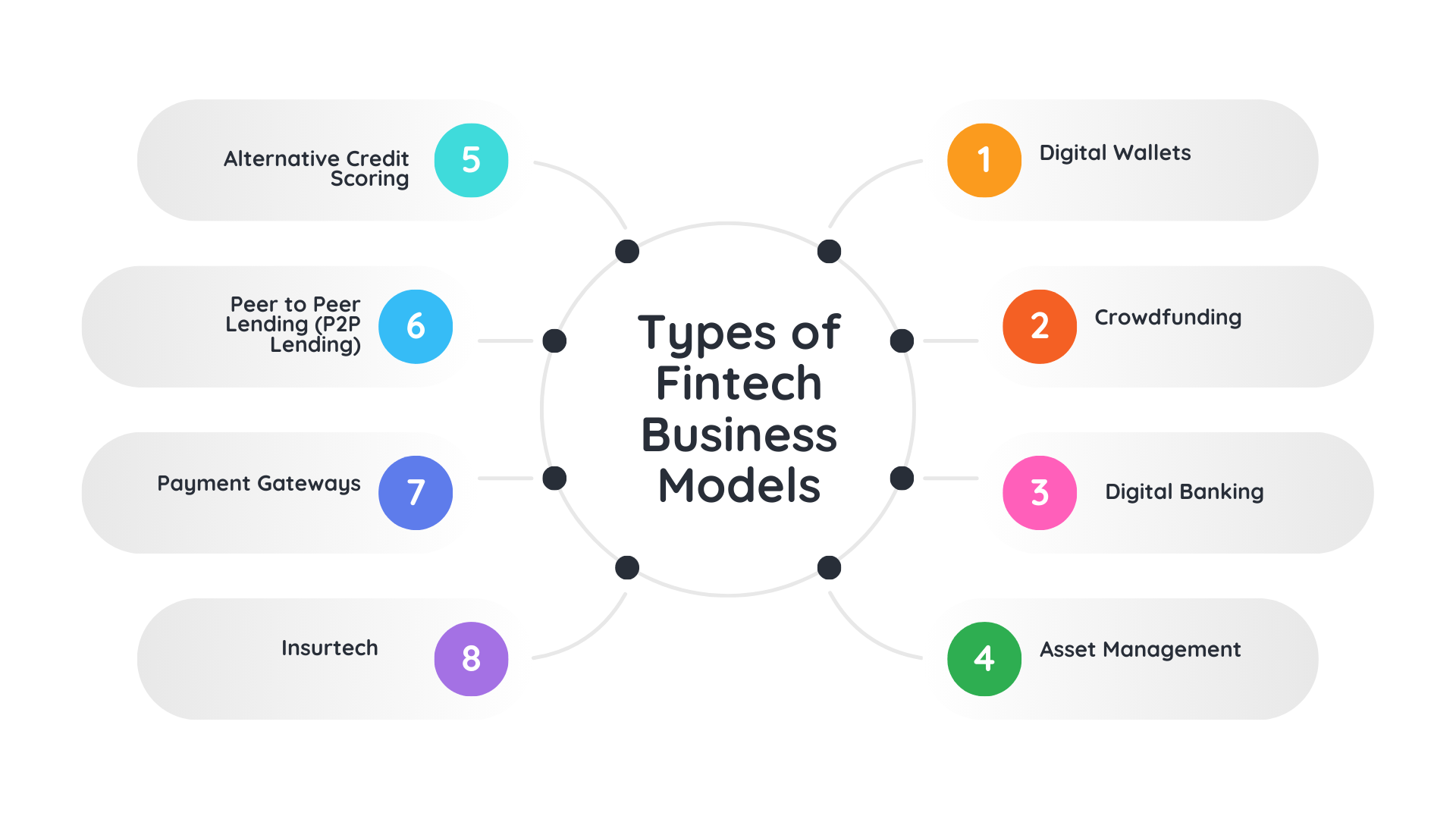

Types of Fintech Business Models

Alternative Credit Scoring

Traditional credit scoring systems often exclude self-employed individuals due to rigid evaluation standards. To overcome this, fintech applications like Nova Credit utilize alternative data, such as social media behavior and comparative scoring within similar borrower categories, to assess creditworthiness. These systems are powered by advanced, self-learning algorithms that consider qualitative inputs, allowing lenders to make more accurate lending decisions and reduce risk by identifying negative borrower profiles before disbursing funds.

Peer-to-Peer Lending (P2P Lending)

The P2P lending industry is projected to grow significantly, reaching USD 912.43 billion by 2028, up from USD 138.71 billion in 2020, at a CAGR of 26.6%. This model allows individuals and businesses to lend or borrow funds directly, bypassing traditional financial intermediaries. For investors, it offers higher returns compared to conventional debt instruments. Fintech app development companies like Funding Circle facilitate this model by creating platforms that match borrowers with lenders, earning revenue through service fees.

Payment Gateways

An online payment gateway lets customers pay for a product on a retailer’s site. Nowadays, banks charge high fees for debit cards, digital wallets, credit cards, and cryptocurrencies. But, FinTech companies are using a model that permits them to consolidate all of these payment methods into a single app that online merchants can effortlessly download and deploy on their website. You can hire an app development company to develop applications like Alipay, iZettle, Stripe, PayPal, and so on, which are ideal for businesses selling physical goods and services to customers.

Insurtech

By integrating AI, blockchain, and big data analytics, insurers are creating faster and more efficient services. Digital platforms such as PolicyBazaar, Acko, and Turtlemint use fintech applications to help users compare and purchase insurance effortlessly. For example, platforms like Digital Insurance use blockchain app development services to accelerate claims processing securely and efficiently.

Digital wallets

Digital wallets are systems that securely store payment credentials, usernames, and passwords for diverse payment methods available as mobile and web app development solutions.With features like NFC and online transfer support, these wallets enable quick and seamless transactions. A fintech app development company can develop wallet solutions like Paytm, JioMoney, Freecharge, or JusPay to cater to modern payment needs across different channels.

Crowdfunding

The idea of Crowdfunding enables startups to gather funding from a large pool of small investors. These platforms present business concepts, goals, and progress updates, allowing investors to evaluate and contribute based on interest. Fintech app developers build scalable and secure crowdfunding platforms that promote transparency, enabling a wide range of funding opportunities for innovators and entrepreneurs.

Digital banking

With fully online infrastructure, users can manage both personal and business accounts seamlessly. Fintech development companies help traditional banks transition to digital platforms. Banks like N26 provide banking services through mobile and web apps, lowering operational costs and offering competitive pricing thanks to reduced overhead.

Asset management

The platforms like Robinhood have disrupted traditional investing by offering commission-free trading. In exchange, fintech companies may monetize user behavior data, offering insights to high-frequency traders. Despite slight price differences in assets, users benefit by saving on fees, a result of fintech business models that prioritize accessibility and cost-efficiency.

Digital insurance

Fintech companies now offer life and health coverage tailored to individual profiles, often at more competitive rates than traditional providers. By leveraging automation, AI, and data-driven marketing, they unlock new customer segments. Lemonade is a prime example, delivering affordable home insurance through a tech-enabled platform.

API-based bank-as-a-service

The API-based bank-as-a-service platforms provide the technological infrastructure for fintech startups to integrate with legacy banking systems. These platforms enable quick rollouts of financial products, reduce time-to-market, and ensure compliance. By collaborating with a skilled fintech app development company, businesses can launch flexible and secure financial services to serve evolving user demands efficiently.

FinTech App Development Tools & Technologies

Fintech applications require a well-structured technology stack to ensure reliability, security, and performance. To build fintech apps that meet modern user expectations and regulatory standards, fintech app developers use a combination of cutting-edge tools, languages, and platforms.

Programming Languages

Fintech app development often relies on versatile programming languages such as Python, Java, Swift, Kotlin, and JavaScript. These languages offer the stability and scalability needed for developing both mobile and web-based financial applications.

Frameworks and Libraries

To accelerate development and support cross-platform compatibility, fintech app developers use frameworks like Flutter, React Native, Angular, and Node.js. These tools enhance UI responsiveness and enable real-time interactions in fintech applications.

Cloud Infrastructure

Cloud service providers like AWS, Google Cloud, and Microsoft Azure offer scalable and secure environments for hosting financial data. By using cloud technologies, a fintech development company can ensure efficient performance and easy integration of new features.

APIs and Integrations

Building a successful fintech app requires integration with various third-party services, including payment gateways, banking systems, KYC/AML services, and credit scoring platforms. APIs like Stripe, Razorpay, and PayPal make it easier to process payments and offer seamless banking experiences.

Security Measures

Ensuring the protection of sensitive data is critical. Fintech app development companies implement encryption protocols, biometric authentication, multi-factor authentication, and tokenization to prevent data breaches and comply with industry regulations such as PCI-DSS and GDPR.

Artificial Intelligence and Data Analytics

AI-powered analytics allow fintech applications to offer personalized insights, automate financial decisions, and detect fraudulent activities. Fintech app developers use machine learning algorithms to provide smarter user experiences and real-time data processing.

Blockchain Integration

For applications that require greater transparency and reduced dependency on intermediaries, blockchain technology is used. Fintech solutions involving smart contracts, digital wallets, and decentralized finance benefit from blockchain’s immutable and decentralized structure.

DevOps and CI/CD Tools

Efficient deployment and continuous updates are possible through DevOps tools like Jenkins, Docker, GitLab CI, and Kubernetes. These tools enable a fintech app development company to manage the development lifecycle smoothly, from coding to deployment.

Choosing the right combination of these technologies allows fintech businesses to develop scalable, secure, and future-ready applications. Working with an experienced fintech app development company helps ensure the application is optimized for performance, security, and growth.

Steps to Create a Fintech App

Creating fintech applications involves a different approach than typical app development projects. Fintech app developers face unique challenges, especially with legal and regulatory compliance being a major concern. Below is a step-by-step outline to guide the development of a fully functional and market-ready fintech app:

Decide on the Right Niche

Fintech applications are diverse, so choosing the right niche is essential before beginning the fintech app development process. Your chosen segment should align with your business goals. In many cases, collaborating with experienced fintech app developers during the early planning stages helps define your audience, objectives, and critical pain points that need solving.

Meet Compliance Requirements

This clarity supports strategic development and makes it easier to evaluate competing products. It also allows a deeper understanding of how existing solutions function, their strengths and weaknesses, user access patterns, and unaddressed user needs.

Identify the Features of the Financial App

In fintech, ensuring regulatory compliance is non-negotiable. A fintech development company must build solutions that follow specific regulations like KYC, AML, GDPR, and other regional privacy laws such as CCPA and LGPD. Failing to meet these standards can lead to legal issues and damage customer trust.

Secure Login

The functionality of fintech apps depends heavily on the niche but typically includes core features. One of the first is secure login. Because these platforms handle sensitive financial information, fintech app developers must integrate strong authentication measures like biometrics, fingerprint scans, and voice recognition to protect user data from unauthorized access.

Push Notifications

Push notifications are another valuable feature in fintech applications. They provide real-time updates on transactions, account activity, and other financial actions, keeping users informed and engaged.

Monitoring Budget and Savings

Helping users manage expenses and savings is also critical. A fintech app that simplifies tracking daily spending and savings goals adds tangible value and encourages user loyalty over time.

Financial Operations

Depending on the app’s purpose, core financial features may include connecting to bank accounts, checking balances, sending or receiving payments, bill payments, personal finance insights, and even investment tracking. Working with a fintech development company ensures the right mix of features is selected based on your target market.

Conversational AI Chatbot

AI-powered chatbots are becoming common in fintech apps. To develop a similar app, you can contact a prominent AI development company. They reduce support wait times and help users get quick answers to financial questions, offering a more seamless and intelligent user experience.

Personalized Experiences

Personalization is also gaining traction in fintech app development. By analyzing user behavior and preferences, developers can tailor app experiences and communications, improving engagement and conversion rates.

Decide on a Team Structure

Once the core strategy is defined, assembling the right development team becomes crucial. Before investing in fintech app development, be sure that your business goals have been carefully analyzed. The team may include frontend and backend developers, designers, quality assurance professionals, business analysts, and a project manager. The team size can scale depending on your project’s complexity.

Fintech Application Design

Fintech application design requires a balance between simplicity and security. The design should avoid unnecessary complexity, incorporate security from the ground up, support all devices, use helpful micro-interactions, and undergo continuous testing to ensure optimal performance and usability.

Development of Fintech MVPs

Developing a Minimum Viable Product (MVP) is a smart way to test your fintech idea. It enables fintech app developers to launch an initial version with core functionality and validate market interest while keeping costs manageable.

Quality Assurance and Launch

Before releasing your product, rigorous testing is necessary. Quality assurance processes carried out by a professional fintech development company will include unit testing, system testing, and user acceptance testing to ensure the final application is stable, secure, and meets the performance expectations of your users.

Most Popular Fintech Product Examples

Payfirma

Michael Gokturk founded Payfirma in 2010 to allow customers to pay any time, anywhere, and at any location. The company helps businesses accept debit and credit card payments online via mobile, e-commerce, and in-store payment terminals under one merchant account. Transactions at Payfirma are processed using a cloud-based platform, which allows business analytics to be accessed quickly, such as sales data.

MANTL

MANTL helps banks and credit unions integrate omnichannel account platforms within their core systems to improve backend tasks and grow deposits. Financial institutions rely on the company for tools that enable them to customize user experiences and branding, implement data visualization tools, and automate KYC decisions in order to increase conversions and simplify deposit processes.

Mogo Inc.

MOGO Finance Technology Inc. (MOGO) is an online lending platform that gives a variety of credit solutions to millennials, including prepaid credit cards and short-term loans. MogoCrypto was released in 2018 for buying and selling Bitcoin. It offers quick access to a competitively priced service and emphasizes the user experience, making it the Uber of finance.

CHIME

Cathay Innovation company Chime (also a CHIME) reimagined how banking works for the underbanked in the US. According to reports, Chime is expanding rapidly, reportedly having over one million customers. Their main strength is their method of generating revenue. A Chime Bank account is free of charge and includes no surprise monthly charges or overdrafts. A pioneer of mobile banking, the most innovative offers no-fee accounts and automatic savings, in addition to early paydays via direct deposit.

Shopify

Founded in 2006, Shopify Inc. provides multi-channel commerce platforms for small and midsize businesses. It was started in 2004 by Daniel Weinand, Tobias Luke, and Scott Lake in Ottawa. With the help of a Shopify development company, developers allow merchants to improve the customer experience as they can directly interact with them and manage multiple channels.

How Much Does It Cost to Create a Fintech App?

Business operations must align with budget constraints and timelines, making careful financial planning crucial before undertaking major investments. While digital payments offer unmatched convenience and security, not all users rely on apps to manage their finances. This makes it essential for every financial transaction to be supported by secure, efficient, and transparent fintech applications.

The cost of fintech app development can vary significantly based on geographic location. For example, hiring fintech app developers in India typically costs between $60 and $80 per hour, whereas in the United States, hourly rates usually range from $100 to $120.

Developing a fintech application with basic functionality for a single platform typically costs between $25,000 and $35,000.The single-platform fintech app development cost with basic functionality is between $25,000 and $35,000.

However, if you’re building a more advanced solution with rich features and custom integrations, the cost may range from $40,000 to $70,000.

For fintech apps with complex interfaces, advanced security features, and compatibility across both Android and iOS, total development costs can range between $50,000 and $150,000, depending on project complexity and specific requirements.

Why is the Fintech Model Advantageous?

High Level of Convenience

Fintech applications are primarily designed for mobile platforms, allowing users to access services easily and perform transactions on the go. This mobile-first approach enhances convenience and expands access. By partnering with a fintech development company, businesses can deliver seamless and responsive customer experiences across devices like smartphones and tablets.

Robo Advisors

Robo-advisors are a fast-growing innovation in fintech app development. These tools leverage algorithms to offer customized investment plans based on user input. They often don’t require minimum deposits and provide low-cost investment options without hidden fees. As a result, they simplify future financial planning and make digital investment accessible to a broader audience.

Further Service Scope

Fintech continues to transform financial services by broadening access and extending operational reach. With a focus on mobile technology, fintech app developers help businesses offer more user-friendly and versatile solutions. These applications enable users to conduct financial activities quickly and reliably, contributing to more streamlined business operations.

Improved Security

Today’s fintech applications are built with robust security protocols, which include biometric authentication, encryption, and tokenization. These measures are critical for protecting user data and maintaining trust. A trusted fintech development company ensures these protections are implemented from the early stages of development and updated regularly to meet compliance standards.

Greater Acceptance Percentage

Fintech has modernized loan approvals and financial access through automation. With AI-enhanced systems, fintech applications can process and approve user requests much faster, sometimes within 24 hours. This automated workflow improves accessibility and user experience while reducing the delays often seen in traditional financial systems.

Lower Costs

Fintech solutions are often more cost-effective than traditional financial services. By minimizing transaction fees and removing hidden charges, they offer better value for both businesses and consumers. Through fintech app development, companies can unify digital and physical payment experiences, cutting costs while offering greater convenience and maintaining a competitive edge.

Concluding Thoughts!!!

The fintech industry has revolutionized how both businesses and consumers handle financial operations, introducing innovation that spans global finance and technology landscapes. A fintech development company can support business owners by optimizing financial models and empowering them to make data-driven decisions.

Despite current market challenges, the fintech industry remains a driving force behind the evolution of modern financial services. Its adaptability and continuous growth signal a strong future, regardless of where these solutions are implemented.

Partner with Experts

Frequently Asked Questions

What are the essential features of a successful fintech app?

Must-have features include:

- Secure authentication (biometrics, two-factor)

- Real-time transaction alerts and push notifications

- Budget tracking and financial insights

- Payment processing and fund transfers

- Customer support via AI chatbots

- Personalization based on user behavior

What challenges do fintech app developers face?

Common challenges include ensuring security, meeting regulatory requirements, integrating with banking systems, building scalable architecture, and providing a seamless user experience across devices.

How important is compliance in fintech app development?

Compliance with regulations such as KYC, AML, GDPR, and other regional data privacy laws is critical to avoid legal penalties and build user trust.

What are common pitfalls in fintech app development?

Pitfalls include underestimating compliance requirements, neglecting security, poor UI/UX design, lack of scalability, and ignoring user feedback. Partnering with an experienced fintech development company helps avoid these risks.