From Slow-Paced Money Transfer to Instant Transactions: Introducing Lightning Payments with P2P Apps.

Remember the days of writing checks and waiting for them to clear? Those long lines in banks just for one money transfer? The ultimate hassle to find the right notary head for troublesome stamps? Forget that! P2P payment apps like Venmo revolutionized payments, making them quicker, more manageable, and more convenient for everyone. This transition wasn’t just about comfort, invention, agility, and entrusting people to take authority over their finances.

Benefits of P2P Payment Apps like Venmo

Visionary leaders brought a fresh perspective to payment apps and saw the opportunity to change the ordinary lives of the general masses. A few advantages that will revolutionize the industry in the upcoming days are:

1. Streamline Daily Lives

No more ATM lines, just quick money transfers between friends, family, and businesses. People’s daily lives are changing the pace of day-to-day functioning. The need to carry cash is no longer in sight with reliable payment apps.

2. Boost Efficiency for Businesses

Frictionless transactions mean happier customers and more instantaneous payments for mid-sized and large companies. Businesses no longer feel the hassle of carrying traditional money everywhere. Seamless business meetings need a streamlined flow of money.

3. Embrace the Future of Finance

P2P apps are built on cutting-edge technology, paving the way for a more inclusive and accessible financial system. Elevating and embracing the future is the primary goal of businesses.

Are you prepared to join the P2P evolution?

Mid-sized businesses and established enterprises choose industry-specific P2P payment app development companies for seamless aid. Such app development companies not only build payment apps fitting the needs of the businesses but also add their valuable insights in context to cognitive technologies. If you look forward to building your own payment app in this saturated market, you must understand what it is and the functionalities, features, types, and benefits to stand out.

What are P2P Payment Apps? How Does P2P Payment App Work?

A peer-to-peer payment app allows two people to transfer money to each other through in-app money transfers using bank accounts or card-based monetary value as the basis of funds. These user-oriented apps directly link peers for speedier and more convenient transactions. Whether it is the handful sum of a $5 coffee or the rent of a flat, all types of transactions are at ease.

Person to person payments function by uniting the payer and the payee with easy processing The payer feeds the exact amount they intend to forward along with the payee’s unique UPI ID or phone number. The funds are transmitted straight from the payer’s bank account, debit card, or credit card to the payee’s P2P account within seconds.

The application utilizes various methods to transfer the money. Few peer payment apps operate with ACH transfers to transfer money through a linked bank account like PayPal and Venmo. ACH transfer is your employer’s exact method to deposit your compensation into your bank account. The transaction will emerge immediately in the Venmo account. Other P2P payment platforms utilize real-time payment networks like Square Cash and Zelle. The transactions made on these apps are quick but may apply some platform fees.

Considering all the cases, the transaction is done from the payer’s account to the platform’s account. The app later transfers the money to the payee’s account. The process transpires behind the settings and offers instant services.

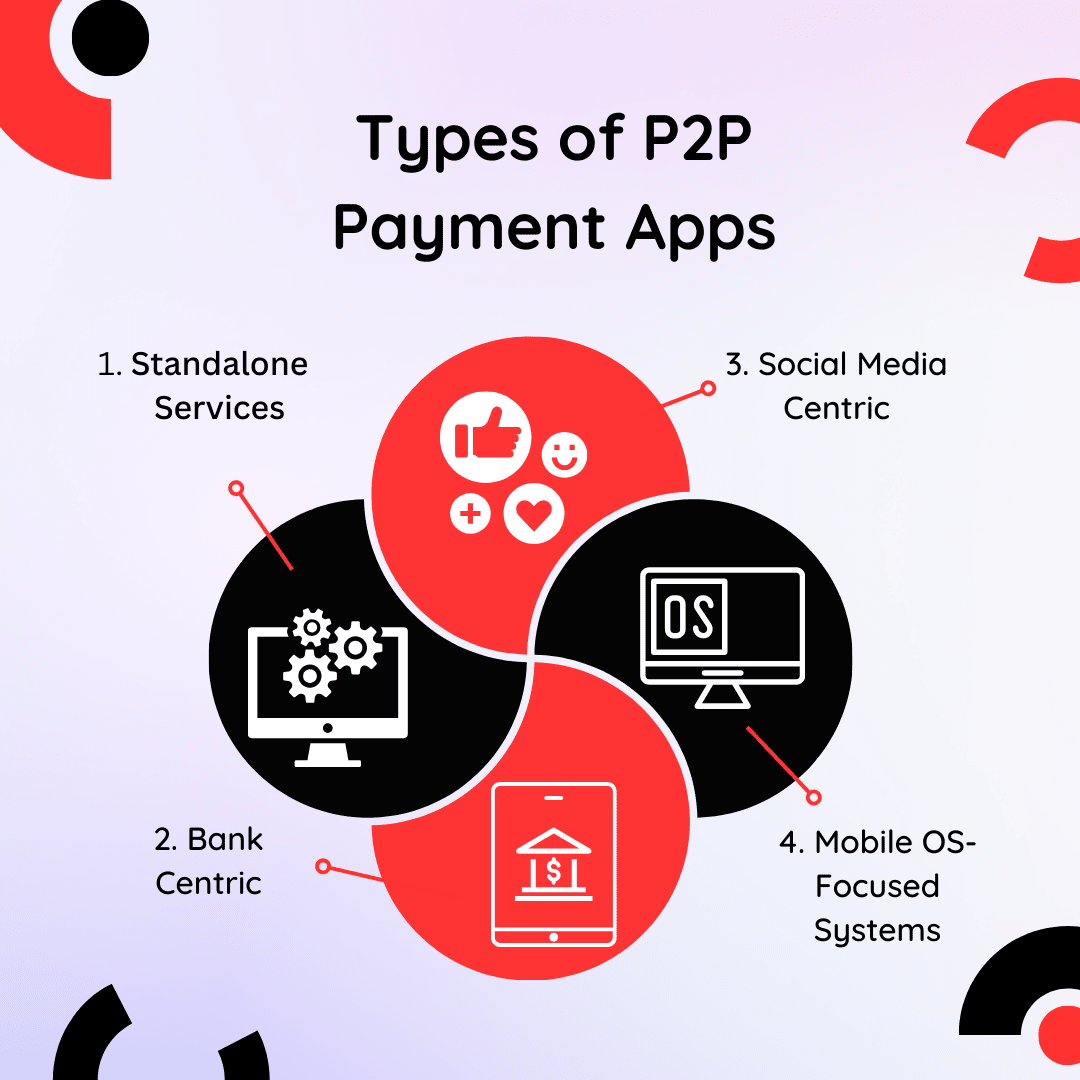

Types of P2P Payment Apps

Comprehending and deciding the type of payment app is crucial for all businesses. One question that comes before how to create a payment app like Venmo is about the type of the app. Keeping the four most popular types of P2P payment apps on the market mentioned below, it is essential to recognize that most P2P apps incorporate various styles. They integrate intelligent features to offer services to diverse user preferences and requirements. Whether through standalone services, social media connectivity, bank integration, or mobile OS integration.

1. Standalone Services

Standalones are P2P payment apps designed primarily to facilitate peer-to-peer money transactions. For instance, splitting bills, making payment transfers, or loaning money to people can be conducted with the standalone payment apps.. They are adaptable and can be utilized for personal money lending and business transactions. Such payment apps guarantee a vast range of features like transaction history, digital wallets, and notifications, making them a widespread choice for users desiring reliable peer-to-peer financial solutions. Some of the most famous examples of standalone payment apps are Venmo and PayPal.

2. Bank Centric

Bank-centric P2P payment apps are incorporated within standard banking apps or proposed as bank accessory services. They encourage users to transmit money, settle bills, and control their finances straight from their current bank accounts. These apps are authorized for data protection and streamlined bank integration, making them exemplary for consumers who choose a harmonious banking experience. Concentrate on the comfort of usage and accessibility when creating these apps to offer the services to a broad user base. Some of the examples of these bank-centric apps are Revolut and Zelle.

3. Social Media Centric

Social media-centric platforms are generally created into widespread social networking platforms, permitting users to transmit money or complete payments within their social networks. Apps based on social media utilize the users’ social connections to facilitate transactions and construct a social payment environment. When developing social media-centric apps, concentrate on data privacy and user authorization. To access contact inventories and guarantee streamlined integration with the social media platform’s interface, businesses must remember that authorization plays a crucial role.

4. Mobile OS-Focused Systems

Mobile OS-focused peer-to-peer payment applications are integrated within operating systems devices like iMessage. These systems allow users to transmit money or make payments without exiting texting or messaging apps. This integration provides a suitable and standard way to exchange money, demanding users who select a native, integrated background. Guarantee compatibility with the distinctive mobile OS’s features and protection standards to accelerate user trust and adoption.

Keeping the requirements and needs of your app in focus, you must look for mobile app development services. The payment application developers align their approach per the app’s needs and types.

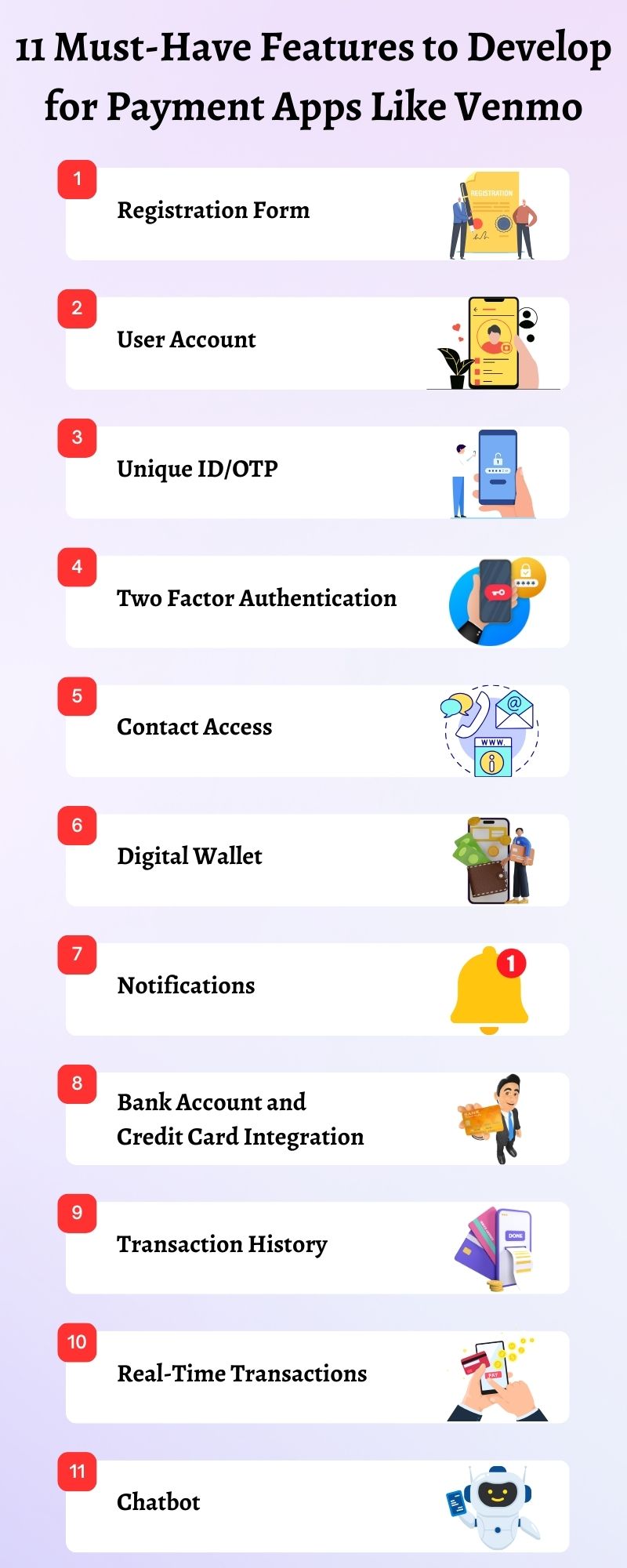

11 Must-Have Features to Develop for Payment Apps Like Venmo

As per Statista, the surveys indicate that 48% of respondents favor using P2P applications for straightforward money transfers. Because global P2P transactions are anticipated to surpass $1927.23 million by 2030, the demand for custom P2P payment app development services is on the rise.

Such forecasts emphasize the user-friendly features that widen the scope of use. Businesses and enterprises must align their app features to the needs of their users. If you are considering to build a payment app, decide on the features and functionalities accordingly.

1. Registration Form

An ideal P2P payment app requires a straightforward and user-friendly registration form to onboard users hassle-free. It should request all the essential data but, at the same time, not request unnecessary information. Enhance the user experience by adding minimum required fields and presenting social media or email signup possibilities to facilitate the function.

Incorporating easy-to-use sign-ups elevates the conversion rate and offers proper reliance. Reducing the bounce rate is the priority while gathering the necessary information. Hire app developers with immense experience to guarantee a streamlined registration form.

2. User Account

Offering the users a customizable account opens the window for a personalized experience. Users prefer personalized experience over off-the-shelf systems as they can modify the app features per their needs. Businesses must understand the reliance on user accounts, proper authorization, and customer offers for their enterprise growth in the long term.

3. Unique ID/OTP

Another essential feature for the improved user experience and robust security is OTP. It is one of the most effortless yet practical payment methods with protection.

For instance, you might have been asked to convey OTP with the e-commerce site or own it for payments. A provisional password is helpful for 5-10 minutes, making the money transactions thrive through an app, and developers can also integrate the option of adding a fingerprint to make it safer.

4. Two Factor Authentication

Two-factor authentication (2FA) improves the safety of a P2P payment app by demanding users offer an extra layer of assurance. Users can utilize this as an additional layer of protection on their payment accounts. Guarantee that the 2FA setup is short and well-explained to facilitate its usage.

During your custom P2P payment app development, ensure your service provider understands the need for 2FA and integrates seamless features.

5. Contact Access

The most uncomplicated way to eliminate the chance of a wrong recipient and enable peer-to-peer digital transactions is to have admission to the users’ contacts. Access to several features permits effortless discovery and contact with friends or connections using the same app. Highlight user privacy by acquiring forthright approval for contact access and presenting possibilities to import or manually add contacts.

6. Digital Wallet

Keeping a unique standing in your application for holding bank cards is a significant feature of P2P payment applications. It supplies users with the comfort and comfort of completing transactions in minimum clicks. A virtual wallet is the crux of any digital wallet app development process, where users keep and handle their funds. Focus on solid security standards, user-friendly interfaces, and considerable currency assistance to make the wallet feature attractive.

7. Notifications

Punctual and pertinent notifications notify users about money transactions, account movements, and noteworthy updates. Users depend on notifications to follow their financial dealings, so they guarantee that notifications are custom as per their needs, non-intrusive, and offer clear and actionable reports. Once a transaction succeeds, the payer and the payee acquire instant, real-time notifications confirming transfer success.

8. Bank Account and Credit Card Integration

Integrating bank accounts facilitates money transfers between the P2P payment app and users’ bank accounts, ensuring streamlined transactions. Businesses must concentrate on safety protocols and provide the integration assistance of various banks and financial institutions.

Mid-sized companies and enterprises must ensure bank account and credit card integration during the systematic mobile app development process. Such features make and break an app for the competitive market.

Raise Your Business With Our Digital Solutions

Request Free Consultation

- On-Time Delivery, Every Time

- 90 Days of Free Support

- 100% Money-back Guarantee

- Strict NDA Policy

9. Transaction History

Users need an effortless pass to their transaction history to observe their financial movements. Present a precise and searchable transaction history with categories, filters, and export possibilities. Guarantee the data is well-protected and smoothly accessible.

10. Real-Time Transactions

Real-time transfer abilities are necessary for users who want instantaneous access to their accounts. Enforce secure and quick peer-to-peer transfers to improve user experience. Consider factors like transaction payments, transaction limitations, and international transfer opportunities when creating this feature.

11. Chatbot

To create a payment app like Zain Cash, considering a chatbot as an exceptional feature is also beneficial. This component enables dealing with different conflicts that can come up when transferring funds through an app, from a lost internet connection during the transaction to the wrong deduction of a specific amount from the wallet.

Also Read – Digital Wallet App Development Guide

Step-By-Step Custom P2P Payment App Development Process

The end-to-end payment app development cycle may appear time-consuming, but businesses can benefit in the long term with a systematic approach.

1. Define Requirements

For the foremost step, outline your payment app specifications. Firm your app notion so you can describe your project needs. Market research and competitor analysis will enable you to comprehend what features are in the market. Requirement collecting from consumers and stakeholders will assist you in summarizing the functional and technical requirements of your P2P payment solutions. Document these into a conditions document, and you will be prepared for the subsequent step.

2. Build Your Payment App Development Team

You will need a qualified app development team to enforce all your selected functionalities. Building a team of essential professionals helps you streamline the P2P payment app development process.

You will need the following professionals:

- UI/UX designers

- iOS, Android, or hybrid app developers as per your project needs

- Technical specialists in emerging technologies such as AI, ML, blockchain, VR development, and many more

- Quality testers

- Project manager

You are ready for the next step once you have all the professionals you need. Businesses and enterprises can also align themselves with a P2P payment application development company that offers them professionals from around the globe.

3. MVP Development

In this case, a minimum viable product would be a simplified version of a full money-transferring app. It allows entrepreneurs to test the waters and comprehend the feasibility of their hypothesis with only must-have features, somewhat of funding heavily in an app that won’t be appropriate or valuable. MVP is usually more affordable than a definitive app as it takes less duration to form. In months, you can have the first interpretation of a product that you can demonstrate to investors and communicate with the foremost users.

4. Design and Prototype

The user interface and experience cover both sides of the interactive step. The minimalistic and user-centric design enables customers to comprehend how to utilize the product. Through similar design instruments, decision-makers can make their product retain the competitive edge and entice and maintain users in the long run.

Based on the data businesses acquired, develop the interface structure and layout features, allowing users to steer through your product. Build wireframes to design the margin on the screen, create mockups, and a UI kit with engraved graphic elements.

5. P2P Payment Development Process

Incorporating safety protocols in mobile application development solutions is something no business should overlook. Simultaneously, your P2P payment app should be integrated with cyber protection and data safety attributes such as face recognition, fingerprint, scanners, etc. Guarantee performance of a two-way authentication feature for ultimate compliance.

For app development, enterprises and businesses should hire a P2P payment app developer with in-depth industry knowledge and a proper understanding of integration and industry trends. With expert insights, businesses can elevate their brand with robust peer-to-peer payments.

6. Quality Assurance

One should never launch a raw, incomplete product. Visualize users encountering a bug when utilizing an app for the first time, will they choose to stay? Quality assurance and testing are necessary stages in the development method, particularly for money-transferring apps. You want to stop possible data infringements and repair any potential mistake that can occur before you deploy your solution to the masses.

7. Deployment

After comprehensive testing and compliance with lawful requirements, the application is deployed for download on different app stores. In parallel, a well-thought-out marketing approach is executed to attract users and forge awareness about the app.

8. Support and Maintenance

The post-launch maintenance and support stage begins after the app deployment. This phase contains bug fixes, user assistance, and ongoing examination. It guarantees the software operates well, reacts to user problems, and alters times to keep the P2P payment solution reliable and secure.

After understanding the development process, the peer-to-peer payment application development cost is one of the primary inquiries businesses request. The following section focuses on providing the decision-makers with an elaborative cost estimate.

How Much Does P2P Payment App Development Costs?

With a straightforward knowledge of building a P2P payment app, it is the moment to comprehend the expenditure of building one. The cost to develop a mobile payment app like Venmo can be analyzed by considering certain factors, most significantly, the intricacy of the application. Let’s have a more in-depth look:

| Peer-to-Peer Payment App Development Cost | |

| Basic P2P Payment App | $40,000 – $120,000 |

| Medium-Complexity P2P Payment App | $120,000 to $200,000 |

| Complex P2P Payment App | $200,000 and above |

The more features, the more the estimated development budget. Considering the feature’s complexity, the app can range from $40,000 to $200,000. You should contact a development partner if you are looking forward to getting a personalized mobile app development cost.

Raise Your Business With Our Digital Solutions

Request Free Consultation

- On-Time Delivery, Every Time

- 90 Days of Free Support

- 100% Money-back Guarantee

- Strict NDA Policy

Why Choose SparxIT to Develop a Venmo-Like Payment App?

SparxIT pursues a stringent security system while offering your business an end-to-end digital payment solution. We hold a rigorous safety strategy throughout the development cycle to protect sensitive financial information adequately. Our end-to-end digital payment apps include contemporary security features to safeguard your FinTech company and client information.

For instance, we operated on a P2P app development project like HexaPay, supporting them in meeting their needs and boosting their revenue. We produced responsible and protected P2P payment apps and became a forward-thinking FinTech app development company.

Frequently Asked Questions

Q1. What is the duration to build a P2P payment app?

A. A simple peer-to-peer payment app development usually takes 3-4 months. Quality assurance, experience, components, and complexity influence the duration spent creating a P2P app.

Q2. How much does P2P payment app development cost?

A. A straightforward P2P app with necessary features can cost about $40,000 – $120,000, whereas a progressive P2P app with advanced features and functionalities requires a capital investment of over $200,000.

Q3. How does P2P apps work?

A. With minimum clicks, the users can choose the recipient’s name, the sending amount, the reason, which can be optional, and the transfer amount to transmit and accept money. Counting on the bank server and the type of assistance used, the peer to peer money transfer could take a few seconds to minutes.

Q4. Are P2P Payments secure?

A. P2P payments are regarded as secure platforms for performing financial transactions. These platforms stick to high regulatory measures for P2P payment app features and utilize different techniques for fraud detection, data encryption, prevention, and two-factor authentication, presenting protection from possible scams.

Comments

No Comments have been posted yet. Please feel free to comment first!Note: Make sure your comment is related to the topic of the article above. Let's start a personal and meaningful conversation!