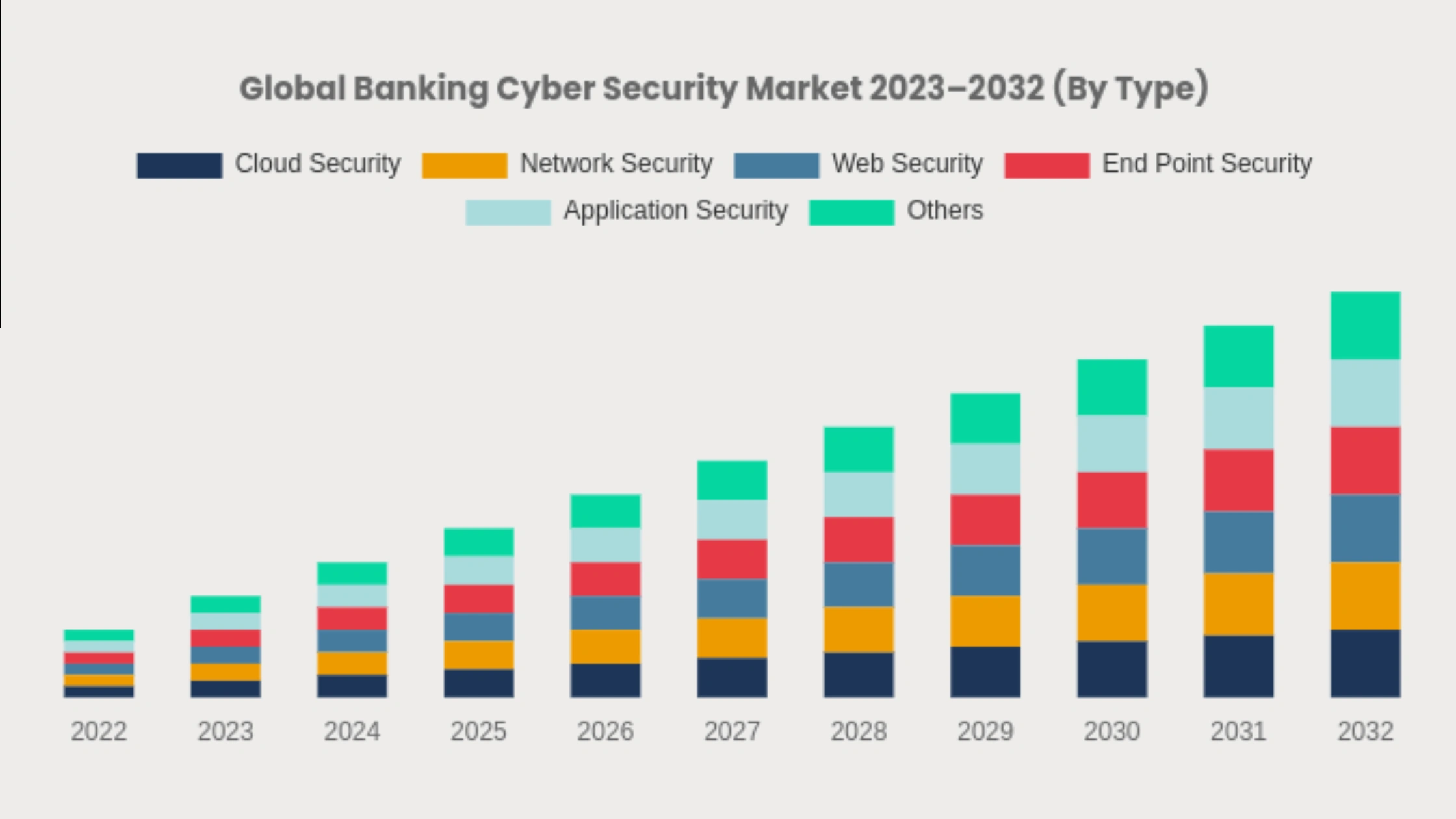

Historically, a bank’s security was measured by the thickness of its steel vaults and the height of its marble counters. Well, the vault has gone virtual, and the stakes have never been higher. The global banking cybersecurity market size was $77.1 billion in 2023 and is projected to reach $285.4 billion by 2032, with a CAGR of 15.2%.

However, the larger expansion has made banks the number one target for a new breed of sophisticated predators. From state-sponsored espionage to AI-powered social engineering, the modern threat landscape is evolving faster than traditional defenses can keep pace.

Cybersecurity in banking is no longer just a line item in an IT budget; it is the cornerstone of global financial governance and the singular prerequisite for customer trust. In an era where a single deepfake can trigger a liquidity crisis, robust cybersecurity solutions are the only currency that truly matters for the modern banking system.

This guide explores the evolving role of cybersecurity, modern threats, emerging solutions, and the future of banking resilience. Additionally, it offers actionable insights that help financial institutions strengthen defenses, protect customer data, and stay ahead of cyber risks.

What is Cybersecurity in Banking?

Cybersecurity in banking is the strategic application of technologies, processes, and controls to protect the CIA Triad (Confidentiality, Integrity, and Availability) of financial data. It is a specialized discipline that defends digital assets from unauthorized access, damage, or exploitation.

The scope of digital banking security extends beyond simple password protection. It involves securing the entire financial ecosystem, including banking apps, core banking servers, ATM networks, and interbank communication channels such as SWIFT.

By establishing a robust defense against malware, hacking, and data theft, banking cybersecurity ensures that every digital transaction remains a secure and verifiable exchange of value.

Importance of Cybersecurity in the Banking Sector

The importance of cybersecurity for banks has transitioned from a technical necessity to a matter of global economic stability. Since banks are the primary repositories of Personally Identifiable Information (PII) and national capital, they serve as high-value targets for cybercriminals.

- A single successful breach can trigger a “systemic risk” event, potentially paralyzing commerce and eroding the trust that keeps financial systems functional.

- Beyond preventing immediate financial losses, cyber security for banks is essential for regulatory compliance with frameworks such as DORA and the CCPA.

- With the global cost of a data breach surging to over $4.4 million, cybersecurity acts as a critical shield against catastrophic fines, legal liabilities, and the irreparable loss of customer confidence.

The Multi-Faceted Role of Cybersecurity in Banking

To understand the true scale of cybersecurity for financial services, one must look at it as a multi-dimensional strategy that supports every function of a modern bank. Its role is not merely defensive; it is an active enabler of the advanced banking system.

-

Protecting Sensitive Data

Banks hold the most sensitive data. Bank cybersecurity ensures that PII, credit scores, and Social Security Numbers are protected from identity theft and unauthorized disclosure. This involves advanced encryption and Data Loss Prevention (DLP) tools that monitor data even when it leaves the bank’s internal perimeter.

-

Ensuring Transaction Integrity

The core of banking is the ledger. Cybersecurity in the banking sector ensures that when you send $100, exactly $100 arrives at the correct destination. By preventing “man-in-the-middle” attacks and unauthorized modifications to the ledger, security protocols maintain the integrity of the global money supply.

-

Maintaining Operational Continuity

For a bank, downtime is measured in millions of dollars per minute. Cybersecurity in banking includes defending against DDoS attacks that aim to paralyze digital services and ensuring customers have uninterrupted access to their funds at all times.

-

Preserving Customer Trust

Trust is the only product a bank truly sells. By transparently protecting assets and proactively notifying users of threats, cybersecurity in digital banking serves as a “Trust Engine” that drives customer loyalty and long-term retention.

-

Improving Risk Management

Modern security tools provide real-time visibility into the bank’s digital health. This data allows leadership to make informed decisions about technology investments and insurance coverage, turning information security in the banking sector into a strategic asset.

-

Enhancing Incident Response

A key benefit of cybersecurity in banking is resilience. It is the ability to bounce back. By establishing Incident Response Plans (IRP), banks can minimize the “blast radius” of an attack. It ensures that even if cybersecurity breaches in banking occur, the recovery is swift.

Major Cyber Threats Targeting Banking Security Systems

In 2026, the primary threat to financial institutions is no longer the lone hacker but organized, state-sponsored syndicates using AI to automate destruction. As banks become more integrated, their “attack surface” expands, creating new entry points for malicious actors.

-

Phishing & Social Engineering Attacks

Today, attackers use Generative AI to create hyper-personalized “spear-phishing” campaigns that mimic the exact tone and context of a bank’s internal communications. Vishing (voice phishing) has also been used through deepfake audio. It allowsfraudsters to impersonate CEOs or high-level executives to authorize fraudulent wire transfers.

-

Ransomware & Malware Injections

Attackers no longer just encrypt a bank’s data; they steal personal data, threaten to leak it publicly, and even harass the bank’s customers directly to force a payout. For many banks, defending against these injections is a core part of their application security services.

-

DDoS Attacks on Banking Servers

Distributed Denial of Service (DDoS) attacks remain a favorite tool for geopolitical actors looking to destabilize a nation’s economy. By overwhelming a bank’s servers with massive traffic, they paralyze digital banking. This causes massive reputational damage and erodes customer trust in real-time.

-

Insider Threats & Employee Negligence

The most dangerous threat often comes from within. Whether through malicious intent or simple human error (misconfiguration), insider threats account for nearly 76% of banking data breaches. This highlights the urgent need for cybersecurity consulting services that focus on internal governance and privilege management.

-

ATM Skimming & Card Frauds

While digital threats dominate the headlines, physical ATM skimming remains a multi-billion-dollar problem. Modern “shimmers” are paper-thin devices embedded in card readers that are nearly impossible for customers to detect visually.

-

API Vulnerabilities in Open Banking

The shift toward Open Banking has turned APIs into the primary plumbing of the financial world. However, poorly secured APIs can expose sensitive data or allow unauthorized transactions. Securing these gateways is a top priority in banking software development for modern fintech ecosystems.

-

Attacks on Supply Chain

Banks are increasingly reliant on third-party vendors for everything from cloud hosting to payroll. A single vulnerability in a partner’s software can provide a “backdoor” into the bank’s core systems. This makes vendor risk management a non-negotiable part of enterprise app security.

How Emerging Technologies Are Strengthening Online Banking Security

As financial institutions face an unprecedented volume of attacks, they are turning to advanced technologies to build a more resilient infrastructure. These innovations represent a fundamental shift in how cybersecurity in digital banking is conceived and executed.

-

Zero Trust Architecture (ZTA)

ZTA operates on the principle of “never trust, always verify.” Every user, device, and application is treated as a potential threat regardless of its location. By enforcing strict identity verification, banks can ensure that even if a hacker gains entry to a low-level system, they cannot move “laterally” to reach the core ledger or sensitive customer databases.

-

Multi-Factor Authentication (MFA)

MFA uses artificial intelligence services to analyze the context of a login attempt, such as the user’s location, device health, and time of day. If the risk score is high, the system may require additional biometric proof or even deny access entirely, even if the correct password is provided.

-

End-to-End Encryption (E2EE)

In modern banking, E2EE ensures that sensitive data is scrambled from the moment it leaves a customer’s device until it is processed by the bank’s secure servers. This prevents “man-in-the-middle” attacks where hackers try to intercept data in transit.

-

AI & Machine Learning for Threat Detection

AI and advanced machine learning services ingest billions of transaction data points in real-time to establish a “baseline” of normal behavior. When a transaction deviates (e.g., a sudden large transfer to a high-risk jurisdiction), the AI can flag or block it in milliseconds.

-

Behavioral Biometrics Authentication

This technology monitors how a user interacts with their device, like their typing rhythm, mouse movements, and even the angle at which they hold their phone. Because these patterns are nearly impossible to replicate, they provide a powerful layer of data security in the banking industry.

-

Firewalls, IDS, and IPS

Next-generation firewalls (NGFW) and Intrusion Detection/Prevention Systems (IDS/IPS) act as the “digital customs agents” of the bank’s network. It scans all incoming traffic for the signatures of known malware and blocks suspicious activity before it can enter the internal environment.

-

Blockchain in Banking for Secure Transactions

Blockchain offers banks an immutable, decentralized ledger that is nearly impossible to tamper with. By utilizing private, permissioned blockchains, banks can settle cross-border payments faster and more securely. This is why many banking software development companies are now integrating distributed ledger technology (DLT) into their core offerings.

-

Cloud Computing for Banking

As the industry embraces cloud computing in banking, the focus has shifted to “shared responsibility” security models. Modern cloud-native platforms offer automated patching, encryption at rest, and robust identity management to maintain full control over their most sensitive assets.

Types of Cybersecurity Solutions for Banks

IT teams deploy a specialized AI technology stack designed to detect, neutralize, and deceive attackers. These banking cybersecurity solutions provide the granular visibility required to manage complex digital environments.

-

EDR (Endpoint Detection and Response)

Every ATM, mobile device, and teller workstation is a potential entry point. EDR provides continuous monitoring of these endpoints. It uses behavioral analysis to detect malware and remotely isolates compromised devices before they cause havoc.

-

XDR (Extended Detection and Response)

XDR unifies telemetry across endpoints, networks, and cloud workloads into a single, cohesive interface. By correlating data across multiple layers, cybersecurity teams can see the entire “attack chain,” enabling 70% faster response times to multi-vector threats.

-

SIEM (Security Information and Event Management)

The SIEM platform acts as the “central brain” of a bank’s cybersecurity operations. It aggregates logs from every server and application, using correlation engines to identify suspicious patterns that might indicate a slow-and-stealthy breach.

-

Passwordless Authentication (FIDO2/Passkeys)

To eliminate cybersecurity risk in banking and credential theft, banks are using FIDO2 standards and cryptographic passkeys. Users can access their accounts via biometrics or hardware security keys. This removes the “human element” of weak passwords, significantly reducing the success rate of phishing campaigns.

-

Deception Technology

Security teams deploy “honeypots” (fake servers or databases that look real) to lure hackers into a controlled environment. Once an attacker touches a decoy, an alert is triggered, allowing the bank to study the attacker’s tactics without risking actual data

-

Third-Party Risk Management (TPRM)

TPRM tools provide continuous and real-time security scoring for vendors, ensuring that a bank’s supply chain remains as secure as its internal systems. This is often a core component for businesses offering specialized types of cybersecurity services to the financial sector.

Real-World Use Cases of Cybersecurity in the Banking Industry

The world’s largest banks are often the first to test and deploy cutting-edge digital banking security measures. Their successes offer invaluable lessons for the rest of the industry.

JPMorgan Chase & Co. Uses AI & ML for Fraud Detection

As the largest credit card issuer in the U.S., JPMorgan Chase processes over 50 million transactions daily. To manage this volume, the bank implemented OmniAI, an in-house platform designed to apply machine learning at speed and scale.

- The Result: The system maintains sub-80-millisecond response times for real-time analysis. It led to a significant reduction in false positives in anti-money laundering (AML) efforts.

Bank of America Leverages Behavioral Biometrics for Data Protection

Bank of America has moved beyond static passwords to embrace a more fluid security model. By integrating behavioral biometrics, the bank monitors hundreds of passive parameters to verify identity.

- The Result: This “passive authentication” layer detected sophisticated malware, such as the TrickBot Trojan, in real time, which would have otherwise bypassed traditional device recognition.

HSBC Employs Cybersecurity to Defend Against DDoS

In 2025 and 2026, HSBC faced coordinated attempts to disrupt its U.S. and UK online portals. Rather than relying on simple traffic filtering, HSBC used a combination of automated scrubbers to redirect malicious traffic.

- The Result: Despite periodic service disruptions, the bank’s layered defense ensured that customer account integrity remained untouched. It proves that a resilient architecture can “take a punch” without a total loss of data or funds.

Compliance & Regulatory Requirements in Banking Cybersecurity

In 2026, regulatory bodies view digital failure as a systemic risk to national security. To maintain operational licenses, banks must move beyond simple checklists to a state of continuous compliance. Let’s look at global bank cybersecurity compliance in the table below.

Key Banking Cybersecurity Regulations in 2026

| Regulation | Primary Region | Core Objective | Key Requirements |

| DORA (Digital Operational Resilience Act) | European Union (EU) | Operational Resilience | Mandatory Threat-Led Penetration Testing (TLPT) and strict third-party ICT oversight. |

| GLBA (Gramm-Leach-Bliley Act) | United States (U.S.) | Data Safeguarding | Appointment of a qualified security lead and shift to continuous monitoring. |

| PCI DSS (Payment Card Industry Data Security Standard) | Global | Payment Security | Proof of automated security controls and continuous vulnerability management for card data. |

| CCPA (California Consumer Privacy Act) | California (U.S.) | Consumer Privacy | Annual cybersecurity audits and opt-out rights for automated credit decision-making. |

| GDPR (General Data Protection Regulation) | European Union (EU) | Data Privacy | Strict 72-hour breach notification window and the “Right to Erasure” across all systems. |

Proven Cybersecurity Best Practices to Protect Banking Data

In 2026, the complexity of the global financial grid demands a transition from static defenses to a proactive, resilient posture. Implementing these industry-standard practices ensures that your institution remains a hard target for even the most sophisticated adversaries.

- Continuous Monitoring: Use AI and 24/7 Security Operations Centers (SOC) to spot anomalies and block emerging threats in real-time.

- Human Firewall Training: Teach staff to recognize high-tech threats such as generative AI, phishing, and deepfakes through realistic simulations.

- Red Teaming & Pen-Testing: Employ red team services to conduct adversarial simulations. These vulnerability scans test the organization’s detection and response capabilities.

- Network Segmentation: Divide the network into isolated zones so that if one area is hacked, the rest of the bank’s data stays safe.

- Incident Response Planning: Provide a clear “emergency playbook” with automated kill switches and immutable backups to quickly recover from attacks.

- Access Controls: Restrict data access so employees see only what they need for their jobs, minimizing the risk of internal leaks.

Major Cybersecurity Challenges in Banking and Practical Solutions

Navigating financial topography requires overcoming systemic hurdles that often outpace traditional security budgets. Addressing these implementation challenges in banking is critical for maintaining long-term institutional resilience.

Challenge 1: Burden of Legacy Infrastructure (Technical Debt)

Many established banks still operate on decades-old COBOL-based systems that lack native support for modern encryption and real-time monitoring.

The Solution: Rather than a total “rip-and-replace,” banks can use secure API wrappers and microservices to modernize legacy systems. This allows for a modular transition to the cloud, enabling modern security protocols to guard older data environments.

Challenge 2: Weaponization of Artificial Intelligence (AI vs. AI)

Hackers are now using generative AI to launch hyper-personalized phishing and automated malware that evolves to bypass firewalls.

The Solution: Banks must fight fire with fire by integrating AI in Cybersecurity. Automated threat-hunting tools can detect “machine-speed” attacks that human analysts cannot spot in real time.

Challenge 3: Widening Cybersecurity Talent Gap

The demand for elite security professionals far exceeds the supply, leaving many internal IT teams stretched thin.

The Solution: Leading institutions are partnering with cybersecurity consultant companies to augment their workforce. They provide access to high-level expertise and 24/7 monitoring.

Challenge 4: Supply Chain and Third-Party Vulnerabilities

As banks integrate more Fintech partners, their security is only as strong as the weakest link in their supply chain.

The Solution: Implement strict Third-Party Risk Management (TPRM) and enterprise application security audits for every vendor. Continuous monitoring of third-party access ensures that a partner’s breach doesn’t become your catastrophe.

The Future of Cybersecurity in Banking

As we look ahead, the banking sector is moving toward a “self-healing” security model. The evolution of AI in Cybersecurity will be the primary driver of this digital transformation. Let’s look at the future trends for cybersecurity in banking.

| Future Trend | What it is | Strategic Benefit |

| Agentic AI | Autonomous “security AI agents” that decide and act without human help. | Neutralizes threats at machine speed by instantly isolating hacked nodes. |

| Post-Quantum Cryptography | New encryption designed to resist future quantum computer attacks. | Future-proofs financial data against “harvest now, decrypt later” tactics. |

| Decentralized Identity | User-owned digital IDs verified via blockchain and biometrics. | Eliminates mass data breaches by removing central “honeypot” databases. |

| Shift-Left DevSecOps | Integrating automated security tests at the very start of coding. | Secures-by-design, making vulnerabilities much cheaper and faster to fix. |

Deploy Next-Gen Cybersecurity Solutions in Banking with SparxIT Expertise

As the industry evolves, staying ahead of sophisticated threats requires a strategic overhaul of your banking IT security. At SparxIT, we empower financial institutions to build unshakeable trust through advanced fintech security and cloud-native protection.

Our team specializes in deploying Zero Trust architectures, AI-driven fraud detection, and automated threat hunting systems tailored for the modern economy. By integrating DevSecOps services and regulatory compliance (DORA, GDPR) into your core infrastructure, we ensure your data remains resilient against emerging risks.

Partner with us to implement cybersecurity in banking, optimize banking app development, and protect your customers’ assets with world-class cyber defense strategies. Ready to fortify your institution? Contact us today for a comprehensive security assessment and future-proof your banking ecosystem.

Partner with Experts

Frequently Asked Questions

How long does it take to implement cybersecurity for financial services?

Implementing cybersecurity in financial services typically takes 4–12 weeks for core measures like MFA, encryption, and threat monitoring. Full-scale upgrades involving broader bank cybersecurity, information security in the banking sector, and enhancements to banking app cybersecurity can take 3–9 months, depending on system complexity and compliance requirements.

How much does it cost to prevent cybersecurity breaches in banking?

Preventing cybersecurity breaches in banking can cost $40,000 to $120,000 per year for mid-sized institutions and $120,000 to $300,000 for large banks. Total investment depends on risk exposure, digital channels, and the level of bank cybersecurity, app protection, and information security needed.

What steps can banks take to improve overall bank cybersecurity?

Banks can improve cybersecurity by enforcing strong access controls, encrypting financial data, securing APIs, conducting regular penetration testing, and using AI-driven monitoring tools that identify suspicious activity in real time.

How can users improve their banking app cybersecurity on mobile devices?

Users can improve cybersecurity on banking apps by enabling MFA, using biometrics, avoiding public Wi-Fi, updating the app regularly, and installing apps only from trusted app stores.